Pizza Hut 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement36

Proxy Statement

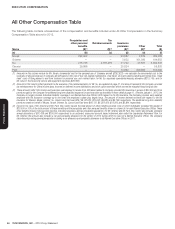

EXECUTIVE COMPENSATION

is based on our belief that the correct calibration of complexity and

responsibility (and therefore market values) lies between corporate-

reported (or divisional) revenues and system wide revenues. The

application of this philosophy means that, for purposes of the

2012 benchmarking, the Company, when considering franchisee

sales, was viewed as having estimated revenues of $18.3billion.

Specifi cally, this amount was determined by adding 2011 estimated

Company sales of $10.7billion and 25% of estimated franchisee

and licensee sales (from which the Company derives revenues

in the form of royalties) of $30.5billion. (Revenue from 2010 was

used for peer companies since the benchmarking was prepared

at the end of 2011 for making pay decisions in 2012 and at that

time the most recent publicly available information for all of the

peer companies dated from year-end 2010.)

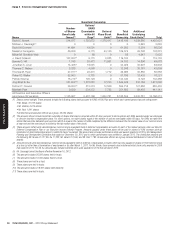

Comparator Compensation Data

One of the factors our Committee uses in setting executive

compensation is an evaluation of how our target and actual

compensation levels compare to those of similarly situated

executives in our Executive Peer Group. The Company has a

philosophy for its Named Executive Offi cers (other than for the CEO)

to target the 50th to 75th percentile for base salary, 75th percentile for

target bonus and 50

th

percentile for long-term incentives. For the

Chief Executive Offi cer, the Company generally attempts to deliver

pay at the 75

th

percentile of the market if he and the Company

have superior performance, specifi cally, 75th percentile total cash

and total direct compensation. For 2012, his total compensation

was slightly below the 75th percentile.

Meridian provided the Executive Peer Group compensation data

to the Committee and it was used as a frame of reference for

establishing compensation targets for base salary, annual bonus

and long-term incentives for all of the Named Executive Offi cers.

The Committee uses this market information as a point of reference

in considering potential compensation decisions. However, this is

not the only factor considered for our Named Executive Offi cers’

compensation, and it does not supplant the analyses of the individual

performance of all of the Named Executive Offi cers. Because the

comparative compensation information is one of several factors

used in the setting of executive compensation, the Committee

applies discretion in determining the nature and extent of its use.

Decisions Impacting Chief Executive Offi cer 2012 Pay

For 2012, the Committee determined that our Chief Executive

Offi cer’s base salary, target bonus and long-term incentive target

were competitive as compared to our Executive Peer Group and

it did not increase any of these elements.

In January2012, the Committee made the following changes for

the Chief Executive Offi cer in order to ensure actual pay refl ects our

target pay philosophy:

•

Consideration of Actual Bonus Paid – Used actual bonus paid

rather than target bonus when benchmarking pay opportunities

with the Executive Peer Group.

•

Determin ation of Stock Appreciation Rights – Determin ed the

amount of his stock appreciation rights using an expected grant

date fair value based on the full term rather than the expected

term as this refl ected the actual historical holding periods for

stock appreciation rights grants to our Chief Executive Offi cer

and, therefore, a more appropriate method of determin ing the

award amount.

Effective January 1, 2012, the Committee discontinued Mr. Novak’s

accruing nonqualified pension benefits under the Pension

Equalization Plan (PEP) and, effective January 1, 2013, replaced

his PEP benefi t with a pension account determined under the

Leadership Retirement Plan. The Committee made this change

to provide Mr. Novak a long term benefi t that is similar to what

he would have received under PEP assuming historically normal

interest rates, and to provide him an annual benefi t amount that

will not fl uctuate from year-to-year due to interest rate volatility.

Beginning in 2013, Mr. Novak will receive an allocation to his

pension account equal to 9.5% of his salary and target bonus and

will receive an annual interest allocation on his account balance

equal to 120% of the applicable federal rate. (See footnote (5) to

the Summary Compensation Table at page 45 for more detail.)

Base Salary

We pay base salary to compensate our Named Executive Offi cers

for their primary roles and responsibilities and to provide a stable

level of annual compensation. A Named Executive Offi cer’s actual

salary varies based on the role, level of his responsibility, experience,

individual performance, future potential and market value. Specifi c

salary increases take into account these factors. In addition, salary

increases may be warranted based on a promotion or change in

the responsibilities of the Named Executive Offi cer. The Committee

reviews the Named Executive Offi cers’ salary and performance

annually.