Pizza Hut 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement22

Proxy Statement

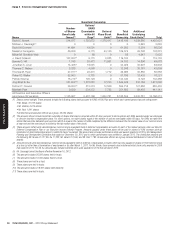

ITEM4RE-APPROVAL OF YUM! BRANDS,INC. LONGTERM INCENTIVE PLAN PERFORMANCE MEASURES

awards in jurisdictions outside the UnitedStates, the Committee

has the authority and discretion to modify those restrictions as the

Committee determines to be necessary or appropriate to conform

to applicable requirements or practices of jurisdictions outside of

the UnitedStates. The Committee has the authority and discretion

to interpret the LTIP, to establish, amend, and rescind any rules

and regulations relating to the LTIP, to determine the terms and

provisions of any award agreement made pursuant to the LTIP,

and to make all other determinations that may be necessary or

advisable for the administration of the LTIP. Any interpretation of the

LTIP by the Committee and any decision made by it under the LTIP

is fi nal and binding on all persons. Except to the extent prohibited

by applicable law or the applicable rules of a stock exchange, the

Committee may allocate all or any portion of its responsibilities

and powers to any one or more of its members and may delegate

all or any part of its responsibilities and powers to any person or

persons selected by it. Until action to the contrary is taken by the

Board or the Committee, the Committee’s authority with respect

to matters concerning participants below the Executive Offi cer

level is delegated to the Chief Executive Offi cer and Chief People

Offi cer of the Company.

Eligibility. The Committee may grant one or more awards to

any employee of the Company or its subsidiaries (determined in

accordance with the LTIP) and to any director of the Company (the

“Participants”). Awards may be granted to an eligible individual

in connection with hiring, retention or otherwise and prior to the

fi rst day on which the eligible individual provides services to the

Company or its subsidiaries (provided that the award may not vest

until the individual fi rst performs services). As of December29,2012,

the Company and its subsidiaries had approximately 523,000

employees. The specifi c Participants who are granted awards

under the LTIP and the type and amount of any such award is

determined and designated by the Committee.

Awards.

•

OPTIONS. The Committee may grant options under the LTIP

to purchase stock which options may be either non-qualifi ed

stock options or incentive stock options. The purchase price

of a share of stock under each option shall not be less than

the closing price of a share of stock on the date the option is

granted. The option shall be exercisable in accordance with the

terms established by the Committee. In general, the Committee

intends that the option terms will provide that options will become

exercisable in equal proportions on the four anniversary dates

after grant and will require the Participant to be employed up

until the date of exercise. From time to time, the Committee

may award “Chairman’s A wards” for superlative performance.

These grants may vest over four or fi ve years as determined

by the Committee. In any event, the Committee reserves the

right to grant options with other terms that are in accordance

with the terms of the LTIP. The full purchase price of each share

of stock purchased upon the exercise of any option shall be

paid at the time of exercise. Except as otherwise determined

by the Committee, the purchase price shall be payable in cash,

in stock (valued at closing price as of the day of exercise), or

in any combination thereof. The Committee may impose such

conditions, restrictions, and contingencies on stock acquired

pursuant to the exercise of an option as the Committee determines

to be desirable. Except as provided in the LTIP with respect to

adjustment to shares in the event of a corporate transaction,

the exercise price for any outstanding stock option may not

be decreased after the date of grant nor may an outstanding

stock option be surrendered to the Company as consideration

in exchange for the grant of a new stock option with a lower

exercise price.

•

STOCK APPRECIATION RIGHTS. The Committee may grant a

stock appreciation right (“SAR”) in connection with any portion of

a previously or contemporaneously granted option or independent

of any option grant. A SAR entitles the Participant to receive the

amount by which the fair market value of a specifi ed number

of shares on the exercise date exceeds an exercise price

established by the Committee. The exercise price may not be

less than the closing price of a share of the stock on the date

the SAR is granted. Such excess amount shall be payable in

stock, in cash, or in any combination thereof, as determined

by the Committee.

•

OTHER STOCK AWARDS. The Committee may grant stock units

(a right to receive stock in the future), performance shares (a right

to receive stock or stock units contingent upon achievement

of performance or other objectives), performance units (a right

to receive a designated dollar amount of stock contingent on

achievement of performance or other objectives) and restricted

stock and restricted stock units (a grant of stock and the right to

receive stock in the future, respectively, with such shares or rights

subject to a risk of forfeiture or other restrictions that lapse upon

the achievement of one or more goals relating to completion of

service by the Participant or the achievement of performance or

other objectives, as determined by the Committee). Any such

award shall be subject to such conditions, restrictions and

contingencies as the Committee determines.

Vesting. Vesting of restricted shares, restricted stock units,

performance shares or performance units granted to Participants

is based on achievement of performance objectives, completion

of a specifi ed period of service, or both. In the case of awards to

employees, the LTIP requires that, if vesting is contingent solely

on completion of a period of service (and is not granted in lieu of

other compensation), the minimum service required will be three

years (subject to acceleration for death, disability, retirement,

change in control, and certain involuntary termination), except in

the case of annual incentive deferrals where the minimum vesting

period is two years for awards granted in the form of restricted

shares. These awards are granted as a settlement of earned

annual cash incentives and are designed to encourage employee

stock ownership. In addition, employees are permitted to defer

their salary or annual cash incentive into stock units payable at

a date elected by the employee. This feature is also designed to

encourage employee stock ownership.

Performance Goals. The Committee may designate whether any

award being granted to any Participant is intended to be qualifi ed

performance-based compensation. Any such awards designated

as intended to be qualifi ed performance-based compensation shall

be conditioned on the achievement of one or more performance

measures to the extent required by Section 162(m). The performance

goals that may be used by the Committee for the awards described

above may be based on any one or more of the following Company,