Pizza Hut 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 17

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

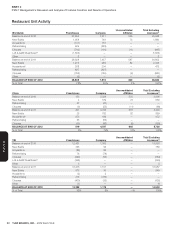

Results of Operations

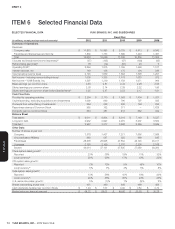

Amount % B/(W)

2012 2011 2010 2012 2011

Company sales $ 11,833 $ 10,893 $ 9,783 9 11

Franchise and license fees and income 1,800 1,733 1,560 4 11

TOTAL REVENUES $ 13,633 $ 12,626 $ 11,343 8 11

COMPANY RESTAURANT PROFIT $ 1,981 $ 1,753 $ 1,663 13 6

% OF COMPANY SALES 16.7% 16.1% 17.0% 0.6 ppts. (0.9 ) ppts.

OPERATING PROFIT $ 2,294 $ 1,815 $ 1,769 26 3

Interest expense, net 149 156 175 5 11

Income tax provision 537 324 416 (66) 22

Net Income – including noncontrolling interest 1,608 1,335 1,178 20 13

Net Income – noncontrolling interest 11 16 20 35 18

NET INCOME – YUM! BRANDS, INC. $ 1,597 $ 1,319 $ 1,158 21 14

DILUTED EPS(a) $ 3.38 $ 2.74 $ 2.38 23 15

DILUTED EPS BEFORE SPECIAL ITEMS(a ) $ 3.25 $ 2.87 $ 2.53 13 14

REPORTED EFFECTIVE TAX RATE 25.0% 19.5% 26.1%

EFFECTIVE TAX RATE BEFORE SPECIAL ITEMS 25.8% 24.2% 25.3%

(a) See Note3 for the number of shares used in these calculations.

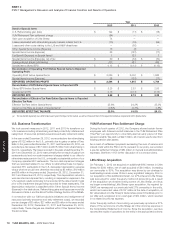

Signifi cant Known Events, Trends or Uncertainties Impacting or Expected to Impact

Comparisons of Reported or Future Results

Special Items

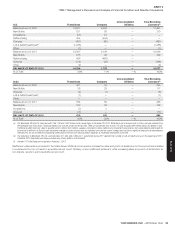

In addition to the results provided in accordance with U.S. Generally Accepted

Accounting Principles (“GAAP”) above and throughout this document, the

Company has provided non-GAAP measurements which present operating

results in 2012, 2011 and 2010 on a basis before Special Items.Included

in Special Items are the U.S. Refranchising gain (loss), the YUM Retirement

Plan settlement charge in 2012, the gain upon acquisition of Little Sheep

in 2012, the losses associated with refranchising equity markets outside

the U.S. and the losses, other costs and tax benefi ts in 2011 relating to

our divestiture of the LJS and A&W brands. Other Special Items Income

(Expense) includes the depreciation reductions from Pizza Hut UK and

KFC U.S. restaurants impaired upon our decision or offer to refranchise

that remained Company stores for some or all of the periods presented,

gains from real estate sales related to our previously refranchised Mexico

business and charges relating to U.S. G&A productivity initiatives and

realignment of resources.

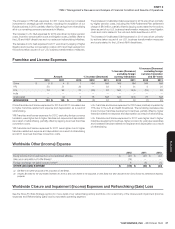

The Company uses earnings before Special Items as a key performance

measure of results of operations for the purpose of evaluating performance

internally, and Special Items are not included in our China, YRI, U.S. or

India segment results.This non-GAAP measurement is not intended

to replace the presentation of our fi nancial results in accordance with

GAAP.Rather, the Company believes that the presentation of earnings

before Special Items provides additional information to investors to facilitate

the comparison of past and present operations, excluding items in 2012,

2011 and 2010 that the Company does not believe are indicative of our

ongoing operations due to their size and/or nature.