Pizza Hut 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 24

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

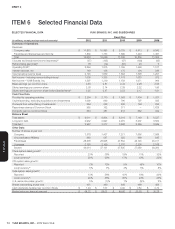

System Sales Growth

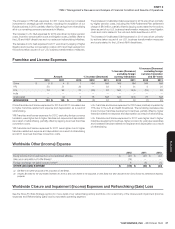

The following tables detail the key drivers of system sales growth for each reportable segment by year.Net unit growth represents the net impact of

actual system sales growth due to new unit openings and historical system sales lost due to closures as well as any necessary rounding.

2012 vs. 2011

China YRI U.S. India Worldwide

Same store sales growth (decline) 4% 3% 5% 5% 4%

Net unit growth and other(a) 16 3 (4) 24 2

Foreign currency translation 3 (3) N/A (16) (1)

53rd week in 2011 N/A (1) (2) N/A (1)

% CHANGE 23% 2% (1)% 13% 4%

% CHANGE, EXCLUDING FOREX

AND 53RD WEEK IN 2011 20% 6% —% 29% 6%

2011 vs. 2010

China YRI U.S. India Worldwide

Same store sales growth (decline) 19% 2% (1)% 10% 3%

Net unit growth and other 10 4 (1) 25 3

Foreign currency translation 6 5 N/A 1 3

53rd week in 2011 N/A 1 2 N/A 1

% CHANGE 35% 12% —% 36% 10%

% CHANGE, EXCLUDING FOREX

AND 53RD WEEK IN 2011 29% 6% (2)% 35% 6%

(a) For the year ended December29, 2012, system sales growth includes a 1% and 5% negative impact for YRI and the U.S., respectively, related to the LJS and A&W divestitures and a 3% positive

impact for China related to the acquisition of Little Sheep. Combined these items had a 2% net negative impact for Worldwide system sales for the year to date ended December29, 2012.

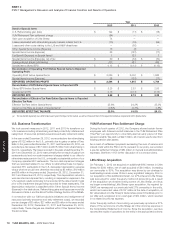

Company-Operated Store Results

The following tables detail the key drivers of the year-over-year changes

of Company sales and Restaurant profi t for each reportable segment by

year.Store portfolio actions represent the net impact of new unit openings,

acquisitions, refranchisings and store closures on Company sales or

Restaurant profi t.The impact of new unit openings and acquisitions

represent the actual Company sales or Restaurant profi t for the periods

the Company operated the restaurants in the current year but did not

operate them in the prior year.The impact of refranchisings and store

closures represent the actual Company sales or Restaurant profi t for the

periods in the prior year while the Company operated the restaurants but

did not operate them in the current year.

The dollar changes in Company Restaurant profi t by year were as follows:

China

2012 vs. 2011

Income/(Expense) 2011

Store Portfolio

Actions Other FX 2012

Company sales $ 5,487 $ 910 $ 249 $ 151 $ 6,797

Cost of sales (1,947) (318) 3 (50) (2,312)

Cost of labor (890) (207) (134) (28) (1,259)

Occupancy and other (1,568) (336) (45) (44) (1,993)

RESTAURANT PROFIT $ 1,082 $ 49 $ 73 $ 29 $ 1,233

Restaurant margin 19.7% 18.1%

Income/(Expense)

2011 vs. 2010

2010

Store Portfolio

Actions Other FX 2011

Company sales $ 4,081 $ 436 $ 720 $ 250 $ 5,487

Cost of sales (1,362) (150) (346) (89) (1,947)

Cost of labor (587) (96) (166) (41) (890)

Occupancy and other (1,231) (159) (107) (71) (1,568)

RESTAURANT PROFIT $ 901 $ 31 $ 101 $ 49 $ 1,082

Restaurant margin 22.1% 19.7%