Pizza Hut 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement 45

Proxy Statement

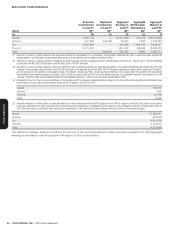

EXECUTIVE COMPENSATION

(1) The amounts reflect compensation for 53weeks in 2011 compared to 52weeks in fiscal 2012 and 2010 due to timing of fiscal period end. Amounts shown are not reduced

to reflect the Named Executive Officers’ elections, if any, to defer receipt of salary into the Executive Income Deferral (“EID”) Program or into the Company’s 401(k) Plan.

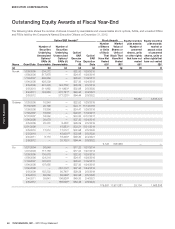

(2) Amounts shown in column (d) represent the grant date fair values for performance share units (PSUs) granted in 2012,2011 and 2010 and restricted stock units (RSUs)

granted in 2012 and 2010. Further information regarding the 2012 awards is included in the “Grants of Plan-Based Awards” and “Outstanding Equity Awards at Fiscal

Year-End” tables later in this proxy statement. The grant date fair value of the PSUs reflected in this column is the target payout based on the probable outcome of the

performance condition, determined as of the grant date. The maximum potential values of the PSUs is 200% of target. For 2012, Mr.Novak’s PSU maximum value at grant

date fair value would be $1,546,044; Mr.Su’s PSU maximum value would be $770,058; Mr.Carucci’s PSU maximum value would be $530,084; and Mr.Pant’s PSU

maximum value would be $500,054. Mr.Grismer did not receive a PSU award for 2012 since he became a Named Executive Officer after PSU awards were granted for

that year. Mr.Grismer was instead permitted to defer his annual incentive award into RSUs under the Company’s EID Program. Under the EID Program (which is described in

more detail beginning on page 53 ), an executive may defer his or her annual incentive award and invest that deferral into stock units, RSUs, or other investment alternatives

offered under the program. An executive who elects to defer his or her annual incentive award into RSUs receives additional RSUs equal to 33% of the RSUs acquired with

the deferral of the annual incentive award (“matching contribution”). For Mr.Grismer, the amount in this column represents the deferral of 100% of his annual incentive

award ($760,760) for 2012, plus his matching contribution ($253,587). In 2010, Mr.Su was the only Named Executive Officer to receive an RSU grant. Mr.Su’s RSU grant

vests after five years and Mr.Su may not sell the shares until 12months following retirement from the Company. The expense of Mr.Su’s award is recognized over the

vesting period.

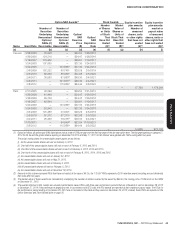

(3) The amounts shown in column (e) represent the grant date fair values of the stock options and stock appreciation rights (SARs) awarded in 2012,2011 and 2010,

respectively. For a discussion of the assumptions and methodologies used to value the awards reported in column(d) and column(e), please see the discussion of

stock awards and option awards contained in PartII, Item8, “Financial Statements and Supplementary Data” of the 2012 Annual Report in Notes to Consolidated

Financial Statements at Note15, “Share-based and Deferred Compensation Plans.”

(4) Except as provided below and in footnote (2) above, amounts in column(f) reflect the annual incentive awards earned for the 2012,2011 and 2010 fiscal year

performance periods, which were awarded by our Management Planning and Development Committee in January2013, January2012 and January2011, respectively,

under the Yum Leaders’ Bonus Program, which is described further in our Compensation Discussion and Analysis beginning at page 30 under the heading “Annual

Performance-Based Cash Bonuses”. Pursuant to SEC rules, annual incentives deferred into RSUs under the EID Program and subject to a risk of forfeiture are reported

in column (d). If the deferral or a portion of the deferral is not subject to a risk of forfeiture , it is reported in column (f). For 2012, Mr.Grismer elected to defer 100%

of his annual incentive ($760,760) into RSUs resulting in nothing to report for him in column (f).

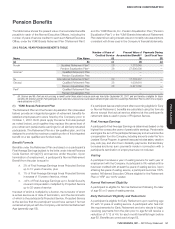

(5) The amount listed under “Change In Pension Value” , column (g) for Mr. Novak, represents his annual accrual from the Retirement Plan for 2012 of $257,215 plus his

2012 nonqualified pension benefit of $1,088,450. As discussed in the Compensation Discussion and Analysis, effective January 1, 2012, the Committee discontinued

Mr. Novak’s accruing nonqualified pension benefits under the Pension Equalization Plan (“PEP”) and, effective January 1, 2013, replaced his PEP benefit with a pension

account determined under the Leadership Retirement Plan (“LRP”). The $1,088,450 reflects the approximate amount Mr. Novak would have accrued during 2012

under the LRP, including both benefit and interest allocations. The amount transferred to his LRP-based pension account effective January 1, 2013 was $27,600,000

(representing his December 31, 2012 estimated lump amount under PEP). Going forward, he will receive a market rate of interest on his pension account plus an

annual benefit allocation equal to 9.5% of his salary plus target bonus.

For Messrs. Su and Carucci, a mounts in column(g) reflect the aggregate increase in actuarial present value of age 62 accrued benefits under all actuarial pension

plans during the 2012 fiscal year (using interest rate and mortality assumptions consistent with those used in the Company’s financial statements) . The change in

pension value for 2012 is mainly the result of a significantly lower discount rate applied to calculate the present value of the benefit. See the Pension Benefits Table

at page 51 for a detailed discussion of the Company’s pension benefits. Mr.Grismer and Mr.Pant were hired after September30,2001, and were ineligible for the

Company’s pension plan.

For M essrs.Grismer and Pant, amounts in column (g) represent the above market earnings as established pursuant to SEC rules which have accrued under each of

their accounts under the LRP , which is described in more detail beginning at page 53 under the heading “Nonqualified Deferred Compensation”.

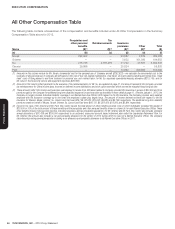

(6) Amounts in column (h) are explained in the All Other Compensation Table and footnotes to that table, which follows.

(7) Mr.Grismer became a Named Executive Officer in May2012. No amounts are reported for Mr.Grismer for the years 2011 and 2010 since he was not a Named

Executive Officer for those years.

(8) No amounts are reported for Mr.Pant for 2010 since he was not a Named Executive Officer for that year.