Pizza Hut 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 30

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

Consolidated Financial Condition

The changes in our Goodwill, Intangible assets, net, Restricted cash, Other liabilities and deferred credits, Investments in unconsolidated affi liates and

Redeemable noncontrolling interest are primarily the result of the Little Sheep acquisition and related purchase price allocation. See Note4.

The decrease in Short-term borrowings was primarily due to the maturity of $263million of Senior Unsecured Notes in July2012.

Liquidity and Capital Resources

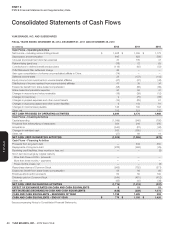

Operating in the QSR industry allows us to generate substantial cash fl ows

from the operations of our company stores and from our extensive franchise

operations which require a limited YUM investment.Net cash provided by

operating activities has exceeded $1billion in each of the last eleven fi scal

years, including over $2billion in both 2012 and 2011.We expect these levels

of net cash provided by operating activities to continue in the foreseeable

future.However, unforeseen downturns in our business could adversely

impact our cash fl ows from operations from the levels historically realized.

In the event our cash fl ows are negatively impacted by business downturns,

we believe we have the ability to temporarily reduce our discretionary

spending without signifi cant impact to our long-term business prospects.Our

discretionary spending includes capital spending for new restaurants,

acquisitions of restaurants from franchisees, repurchases of shares of our

Common Stock and dividends paid to our shareholders.As of December29,

2012 we had approximately $1.2billion in unused capacity under our

revolving credit facility that expires in November2017

China and YRI represented more than 70% of the Company’s segment

operating profi t in 2012 and both generate a signifi cant amount of

positive cash fl ows that we have historically used to fund our international

development.To the extent we have needed to repatriate international cash

to fund our U.S. discretionary cash spending, including share repurchases,

dividends and debt repayments, we have historically been able to do so in

a tax-effi cient manner.If we experience an unforeseen decrease in our cash

fl ows from our U.S. business or are unable to refi nance future U.S. debt

maturities we may be required to repatriate future international earnings

at tax rates higher than we have historically experienced.

We currently have investment-grade ratings from Standard & Poor’s Rating

Services (BBB) and Moody’s Investors Service (Baa3).While we do not

anticipate a downgrade in our credit rating, a downgrade would increase

the Company’s current borrowing costs and could impact the Company’s

ability to access the credit markets cost-effectively if necessary.Based on

the amount and composition of our debt at December29, 2012, which

included no borrowings outstanding under our revolving credit facility, our

interest expense would not materially increase on a full-year basis should

we receive a one-level downgrade in our ratings.

Discretionary Spending

During 2012, we invested $1,099million in capital spending, including

$655million in China, $251million in YRI, $175million in the U.S. and

$18million in India.For 2013, we estimate capital spending will be

approximately $1.1billion.

During the year ended December29, 2012 we repurchased shares for

$985million, which includes the effect of $20million in share repurchases

with trade dates prior to the 2012 fi scal year end but cash settlement

dates subsequent to the 2012 fi scal year.On November18, 2011, our

Board of Directors authorized share repurchases through May2013 of up

to $750million (excluding applicable transaction fees) of our outstanding

Common Stock, and on November16, 2012, our Board of Directors

authorized additional share repurchases through May2014 of up to

$1billion (excluding applicable transaction fees) of our outstanding Common

Stock.At December29, 2012, we had remaining capacity to repurchase

up to $953million of outstanding Common Stock (excluding applicable

transaction fees) under the 2012 authorization. Shares are repurchased

opportunistically as part of our regular capital structure decisions.

During the year ended December29, 2012, we paid cash dividends of

$544million.Additionally, on November16, 2012 our Board of Directors

approved cash dividends of $0.335 per share of Common Stock to be

distributed on February1, 2013 to shareholders of record at the close of

business on January11, 2013.The Company targets an ongoing annual

dividend payout ratio of 35% to 40% of net income.

On February1, 2012, we acquired a controlling interest in Little Sheep

Group Limited (“Little Sheep”), a casual dining concept headquartered in

Inner Mongolia, China for $540million, net of $44million cash assumed.

See Note4 for details.

Borrowing Capacity

On March22, 2012, the Company executed a fi ve-year syndicated senior

unsecured revolving credit facility (the “Credit Facility”) totaling $1.3billion

which replaced a syndicated senior unsecured revolving domestic credit

facility in the amount of $1.15billion and a syndicated revolving international

credit facility of $350million that were both set to expire in November of

2012. The Credit Facility includes 24 participating banks with commitments

ranging from $23million to $115million and expires on March31, 2017.

We believe the syndication reduces our dependency on any one bank.

Under the terms of the Credit Facility, we may borrow up to the maximum

borrowing limit, less outstanding letters of credit or banker’s acceptances,

where applicable. At December29, 2012, our unused Credit Facility totaled

$1.2billion net of outstanding letters of credit of $63million. There were no

borrowings outstanding under the Credit Facility at December29, 2012.

The interest rate for most borrowings under the Credit Facility ranges from

1.00% to 1.75% over the “London Interbank Offered Rate” (“LIBOR”).

The exact spread over LIBOR under the Credit Facility depends upon our

performance against specifi ed fi nancial criteria. Interest on any outstanding

borrowings under the Credit Facility is payable at least quarterly.

The Credit Facility is unconditionally guaranteed by our principal domestic

subsidiaries.This agreement contains fi nancial covenants relating to

maintenance of leverage and fi xed-charge coverage ratios and also contains

affi rmative and negative covenants including, among other things, limitations

on certain additional indebtedness and liens, and certain other transactions

specifi ed in the agreement.Given the Company’s strong balance sheet and

cash fl ows we were able to comply with all debt covenant requirements at

December29, 2012 with a considerable amount of cushion. Additionally,

the Credit Facility contains cross-default provisions whereby our failure to

make any payment on our indebtedness in a principal amount in excess of

$125million, or the acceleration of the maturity of any such indebtedness,

will constitute a default under such agreement.

The majority of our remaining long-term debt primarily comprises Senior

Unsecured Notes with varying maturity dates from 2014 through 2037

and interest rates ranging from 2.38% to 6.88%.The Senior Unsecured

Notes represent senior, unsecured obligations and rank equally in right

of payment with all of our existing and future unsecured unsubordinated

indebtedness.Amounts outstanding under Senior Unsecured Notes

were $2.8billion at December29, 2012. Our Senior Unsecured Notes

provide that the acceleration of the maturity of any of our indebtedness in

a principal amount in excess of $50million will constitute a default under

the Senior Unsecured Notes if such acceleration is not annulled, or such

indebtedness is not discharged, within 30 days after notice.