Pizza Hut 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

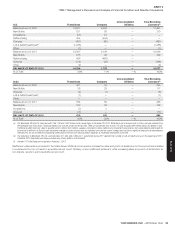

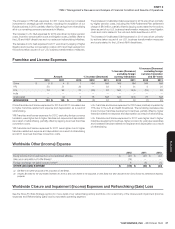

YUM! BRANDS, INC.-2012 Form10-K 33

Form 10-K

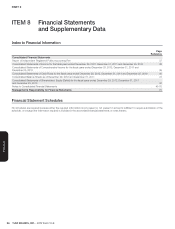

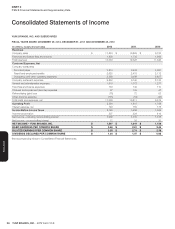

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

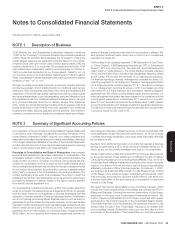

The discounted value of the future cash fl ows expected to be generated by

the restaurant and retained by the franchisee is reduced by future royalties

the franchisee will pay the Company.The Company thus considers the fair

value of future royalties to be received under the franchise agreement as

fair value retained in its determination of the goodwill to be written off when

refranchising.Others may consider the fair value of these future royalties

as fair value disposed of and thus would conclude that a larger percentage

of a reporting unit’s fair value is disposed of in a refranchising transaction.

During 2012, the Company’s reporting units with the most signifi cant

refranchising activity and recorded goodwill were our Taco Bell U.S.

and KFC U.S. operating segments and our Pizza Hut United Kingdom

(“U.K.”) business unit.Within our Taco Bell U.S. operating segment, 181

restaurants were refranchised (representing 15% of beginning-of-year

company units) and $6million in goodwill was written off (representing 5%

of beginning-of-year goodwill). Within our KFC U.S. operating segment,

218 restaurants were refranchised (representing 47% of beginning-of-year

company units) and $7million in goodwill was written off (representing

5% of beginning-of-year goodwill). Within our Pizza Hut U.K. business

unit, 359 dine-in and delivery restaurants were refranchised (representing

86% of beginning-of-year company units) and $16million in goodwill was

written off (representing 16% of beginning-of-year goodwill).See Note4

for a further discussion of our refranchising of Pizza Hut U.K.

See Note2 for a further discussion of our policies regarding goodwill.

Allowances for Franchise and License

Receivables/Guarantees

Franchise and license receivable balances include continuing fees, initial

fees and other ancillary receivables such as rent and fees for support

services.Our reserve for franchisee or licensee receivable balances is based

upon pre-defi ned aging criteria or upon the occurrence of other events

that indicate that we may not collect the balance due.This methodology

results in an immaterial amount of unreserved past due receivable balances

at December29, 2012.As such, we believe our allowance for franchise

and license receivables is adequate to cover potential exposure from

uncollectible receivable balances at December29, 2012.

We issue certain guarantees on behalf of franchisees primarily as a result

of 1) assigning our interest in obligations under operating leases, primarily

as a condition to the refranchising of certain Company restaurants, 2)

facilitating franchisee development and 3) equipment fi nancing arrangements

to facilitate the launch of new sales layers by franchisees.We recognize

a liability for the fair value of such guarantees upon inception of the

guarantee and upon any subsequent modifi cation, such as franchise

lease renewals, when we remain contingently liable.The fair value of a

guarantee is the estimated amount at which the liability could be settled

in a current transaction between willing unrelated parties.

The present value of the minimum payments of the assigned leases,

discounted at our pre-tax cost of debt, is approximately $675million,

at December29, 2012.Current franchisees are the primary lessees

under the vast majority of these leases.Additionally, we have guaranteed

approximately $54million of franchisee loans for various programs.We

generally have cross-default provisions with these franchisees that would

put them in default of their franchise agreement in the event of non-payment

under assigned leases and certain of the loan programs.We believe these

cross-default provisions signifi cantly reduce the risk that we will be required

to make payments under these guarantees and, historically, we have not

been required to make signifi cant payments for guarantees.If payment on

these guarantees becomes probable and estimable, we record a liability

for our exposure under these guarantees.At December29, 2012 we have

recorded an immaterial liability for our exposure under these guarantees

which we consider to be probable and estimable.If we begin to be required

to perform under these guarantees to a greater extent, our results of

operations could be negatively impacted.

See Note2 for a further discussion of our policies regarding franchise

and license operations.

See Note19 for a further discussion of our guarantees.

Self-Insured Property and Casualty Losses

We record our best estimate of the remaining cost to settle incurred self-

insured workers’ compensation, employment practices liability, general

liability, automobile liability, product liability and property losses (collectively

“property and casualty losses”).The estimate is based on the results of an

independent actuarial study and considers historical claim frequency and

severity as well as changes in factors such as our business environment,

benefi t levels, medical costs and the regulatory environment that could

impact overall self-insurance costs.Additionally, our reserve includes a

risk margin to cover unforeseen events that may occur over the several

years required to settle claims, increasing our confi dence level that the

recorded reserve is adequate.

See Note19 for a further discussion of our insurance programs.

Pension Plans

Certain of our employees are covered under defi ned benefi t pension

plans.The most signifi cant of these plans are in the U.S.We have recorded

the under-funded status of $345million for these U.S. plans as a pension

liability in our Consolidated Balance Sheet as of December29, 2012.These

U.S. plans had a projected benefi t obligation (“PBO”) of $1,290million

and a fair value of plan assets of $945million at December29, 2012.

The PBO refl ects the actuarial present value of all benefi ts earned to date

by employees and incorporates assumptions as to future compensation

levels.Due to the relatively long time frame over which benefi ts earned to

date are expected to be paid, our PBOs are highly sensitive to changes

in discount rates.For our U.S. plans, we measured our PBOs using a

discount rate of 4.40% at December29, 2012.This discount rate was

determined with the assistance of our independent actuary.The primary

basis for our discount rate determination is a model that consists of a

hypothetical portfolio of ten or more corporate debt instruments rated Aa

or higher by Moody’s or S&P with cash fl ows that mirror our expected

benefi t payment cash fl ows under the plan.We exclude from the model

those corporate debt instruments fl agged by Moody’s or S&P for a potential

downgrade (if the potential downgrade would result in a rating below Aa

by both Moody’s and S&P) and bonds with yields that were two standard

deviations or more above the mean.In considering possible bond portfolios,

the model allows the bond cash fl ows for a particular year to exceed the

expected benefi t cash fl ows for that year.Such excesses are assumed to

be reinvested at appropriate one-year forward rates and used to meet the

benefi t payment cash fl ows in a future year.The weighted-average yield

of this hypothetical portfolio was used to arrive at an appropriate discount

rate.We also ensure that changes in the discount rate as compared to

the prior year are consistent with the overall change in prevailing market

rates and make adjustments as necessary.A 50 basis-point increase

in this discount rate would have decreased our U.S. plans’ PBOs by

approximately $93million at our measurement date.Conversely, a 50

basis-point decrease in this discount rate would have increased our U.S.

plans’ PBOs by approximately $105million at our measurement date.

The pension expense we will record in 2013 is also impacted by the discount

rate we selected at our measurement date.We expect pension expense

for our U.S. plans to decrease approximately $8million in 2013.The

decrease is primarily driven by a decrease in amortization of net loss due

to lower net unrecognized losses in Accumulated other comprehensive

income.A 50 basis-point change in our discount rate assumption at our

measurement date would impact our 2013 U.S. pension expense by

approximately $13million.