Pizza Hut 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

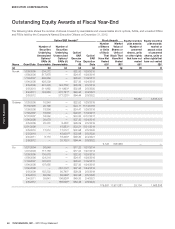

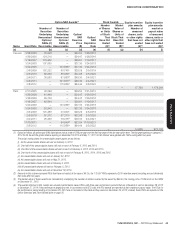

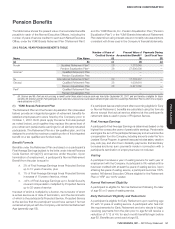

YUM! BRANDS, INC.-2013Proxy Statement58

Proxy Statement

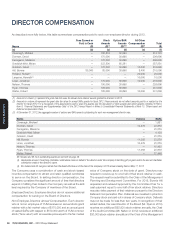

DIRECTOR COMPENSATION

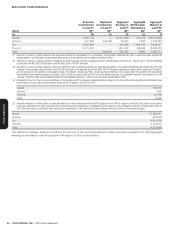

As described more fully below, this table summarizes compensation paid to each non-employee director during 2012.

Name

Fees Earned or

Paid in Cash

($)

Stock

Awards

($)

(1)

Option/SAR

Awards

($)(2)(3)

All Other

Compensation

($)(4)

Total

($)

(a) (b) (c) (d) (e ) (f )

Cavanagh, Michael — 180 ,833 32,290 — 213 ,123

Dorman, David — 170,000 36,696 — 206,696

Ferragamo, Massimo — 170,000 36,696 — 206,696

Graddick-Weir, Mirian — 322,500 65,381 — 387,8 81

Grissom, David — 170,000 36,696 10,000 216,696

Hill, Bonnie 85,000 85,000 36,696 8,400 215,096

Holland, Robert(5) — — — 20,000 20,000

Langone, Kenneth(5) — — — 10,000 10,000

Linen, Jonathan — 170,000 36,696 10,000 216,696

Nelson, Thomas — 190,000 36,696 — 226,696

Ryan, Thomas — 195,000 36,696 — 231,696

Walter, Robert — 185,000 36,696 10,000 231,696

(1) Amounts in column (c) represent the grant date fair value for annual stock retainer awards granted to directors in 2012.

(2) Amounts in column (d) represent the grant date fair value for annual SARs granted in fiscal 2012. These amounts do not reflect amounts paid to or realized by the

director for fiscal 2012. For a discussion of the assumptions used to value the awards, see the discussion of stock awards and option awards contained in PartII,

Item8, “Financial Statements and Supplementary Data” of the 2012 Annual Report in Notes to Consolidated Financial Statements at Note15, “Share-based and

Deferred Compensation Plans.”

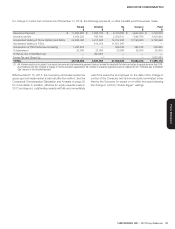

(3) At December31,2012, the aggregate number of options and SARs awards outstanding for each non-management director was:

Name Options SARs

Cavanagh, Michael — 1,981

Dorman, David 10,476 23,879

Ferragamo, Massimo — 23,879

Graddick-Weir, Mirian — 4,120

Grissom, David — 23,879

Hill, Bonnie 11,358 23,879

Linen, Jonathan 10,476 23,879

Nelson, Thomas — 15,462

Ryan, Thomas 11,358 23,879

Walter, Robert — 17,446

Mr.Novak’s and Mr.Su’s outstanding awards are set forth on page 48 .

(4) Represents amount of matching charitable contributions made on behalf of the director under the Company’s matching gift program and/or the amount charitable

contribution made in the director’s name.

(5) Mr.Holland and Mr.Langone retired from the Board effective as of the date of the Company’s 2012 annual meeting held on May17,2012.

The Company uses a combination of cash and stock-based

incentive compensation to attract and retain qualifi ed candidates

to serve on the Board. In setting director compensation, the

Company considers the signifi cant amount of time that directors

expend in fulfi lling their duties to the Company as well as the skill

level required by the Company of members of the Board.

Employee Directors. Employee directors do not receive additional

compensation for serving on the Board of Directors.

Non-Employee Directors Annual Compensation. Each director

who is not an employee of YUM receives an annual stock grant

retainer with a fair market value of $170,000 and an annual grant

of vested SARs with respect to $150,000 worth of YUM common

stock (“face value”) with an exercise price equal to the fair market

value of Company stock on the date of grant. Directors may

request to receive up to one-half of their stock retainer in cash.

The request must be submitted to the Chair of the Management

Planning and Development Committee. For 2012, Bonnie Hill

requested and received approval by the Committee Chair for a

cash payment equal to one-half of her stock retainer. Directors

may also defer payment of their retainers pursuant to the Directors

Deferred Compensation Plan. Deferrals are invested in phantom

Company stock and paid out in shares of Company stock. Deferrals

may not be made for less than two years. In recognition of their

added duties, the Lead Director of the Board (Mr.Ryan in 2012)

receives an additional $25,000 stock retainer annually, the Chair

of the Audit Committee (Mr.Nelson in 2012) receives an additional

$20,000 stock retainer annually and the Chair of the Management