Pizza Hut 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 53

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

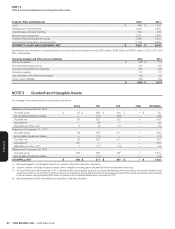

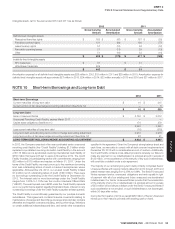

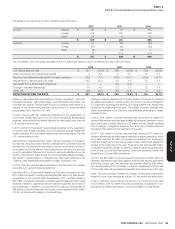

Intangible assets, net for the years ended 2012 and 2011 are as follows:

2012 2011

Gross Carrying

Amount

Accumulated

Amortization

Gross Carrying

Amount

Accumulated

Amortization

Defi nite-lived intangible assets

Reacquired franchise rights $ 163 $ (47) $ 167 $ (33)

Franchise contract rights 131 (84) 130 (77)

Lease tenancy rights 57 (12) 58 (12)

Favorable operating leases 21 (11) 29 (13)

Other 51 (19) 33 (14)

$ 423 $ (173) $ 417 $ (149)

Indefi nite-lived intangible assets

KFC trademark $ 31 $ 31

Little Sheep trademark 409 —

$ 440 $ 31

Amortization expense for all defi nite-lived intangible assets was $28million in 2012, $31million in 2011 and $29million in 2010.Amortization expense for

defi nite-lived intangible assets will approximate $27million in 2013, $24million in 2014, $23million annually in 2015 and 2016 and $21million in 2017.

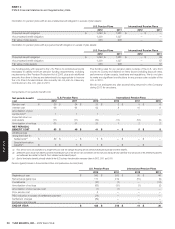

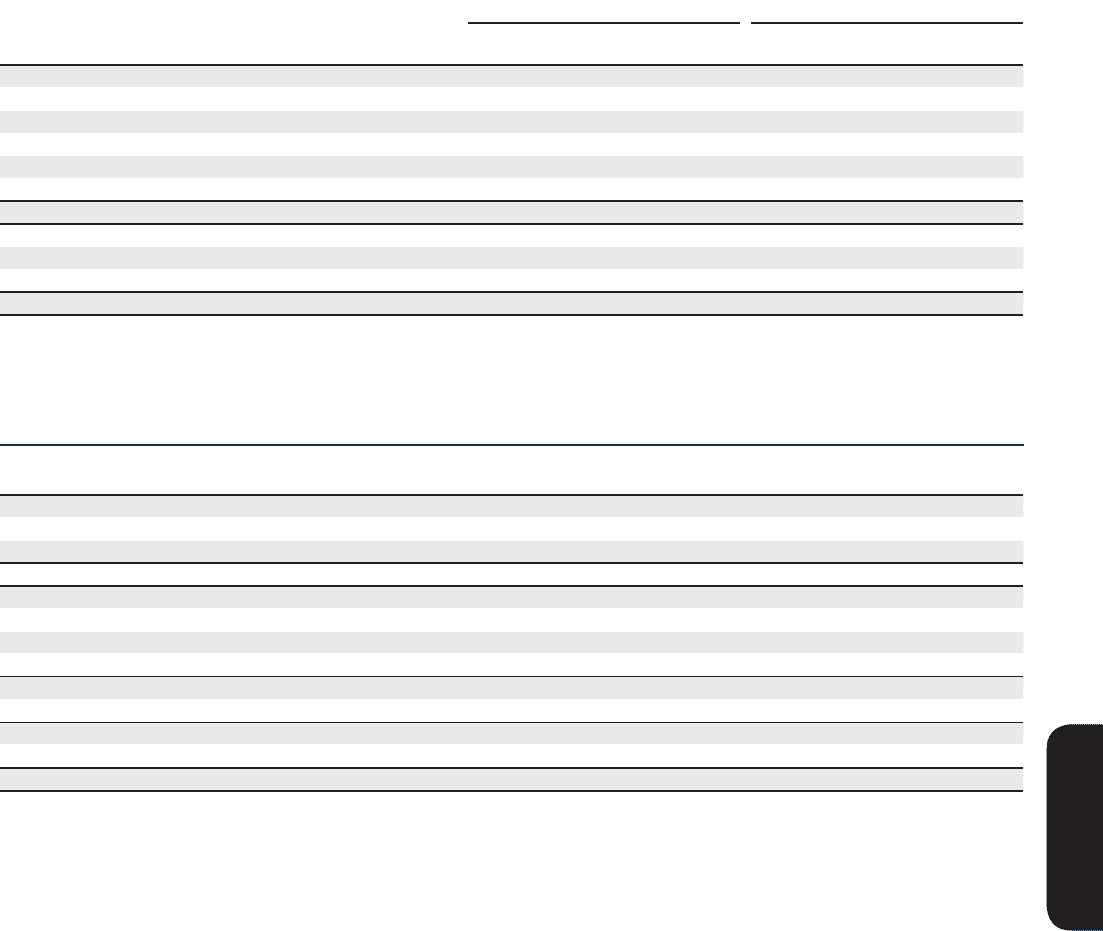

NOTE10 Short-term Borrowings and Long-term Debt

2012 2011

Short-term Borrowings

Current maturities of long-term debt $ 10 $ 315

Current portion of fair value hedge accounting adjustment (See Note12) — 5

$ 10 $ 320

Long-term Debt

Senior Unsecured Notes $ 2,750 $ 3,012

Unsecured Revolving Credit Facility, expires March2017 — —

Capital lease obligations (See Note11) 170 279

2,920 3,291

Less current maturities of long-term debt (10) (315)

Long-term debt excluding long-term portion of hedge accounting adjustment 2,910 2,976

Long-term portion of fair value hedge accounting adjustment (See Note12) 22 21

LONG-TERM DEBT INCLUDING HEDGE ACCOUNTING ADJUSTMENT $ 2,932 $ 2,997

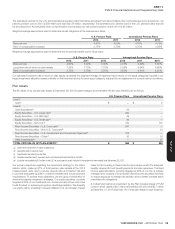

In 2012, the Company executed a fi ve-year syndicated senior unsecured

revolving credit facility (the “Credit Facility”) totaling $1.3billion which

replaced a syndicated revolving domestic credit facility in the amount

of $1.15billion and a syndicated revolving international credit facility of

$350million that were both set to expire in November2012. The Credit

Facility includes 24 participating banks with commitments ranging from

$23million to $115million and expires on March31, 2017.Under the

terms of the Credit Facility, we may borrow up to the maximum borrowing

limit, less outstanding letters of credit or banker’s acceptances, where

applicable.At December29, 2012, our unused Credit Facility totaled

$1.2billion net of outstanding letters of credit of $63million.There were

no borrowings outstanding under the Credit Facility at December29,

2012.The interest rate for most borrowings under the Credit Facility

ranges from 1.00% to 1.75% over the London Interbank Offered Rate

(“LIBOR”).The exact spread over LIBOR under the Credit Facility depends

upon our performance against specifi ed fi nancial criteria.Interest on any

outstanding borrowings under the Credit Facility is payable at least quarterly.

The Credit Facility is unconditionally guaranteed by our principal domestic

subsidiaries.This agreement contains fi nancial covenants relating to

maintenance of leverage and fi xed charge coverage ratios and also contains

affi rmative and negative covenants including, among other things, limitations

on certain additional indebtedness and liens, and certain other transactions

specifi ed in the agreement.Given the Company’s strong balance sheet and

cash fl ows, we were able to comply with all debt covenant requirements at

December29, 2012 with a considerable amount of cushion. Additionally,

the Credit Facility contains cross-default provisions whereby our failure to

make any payment on our indebtedness in a principal amount in excess of

$125million, or the acceleration of the maturity of any such indebtedness,

will constitute a default under such agreement.

The majority of our remaining long-term debt primarily comprises Senior

Unsecured Notes with varying maturity dates from 2014 through 2037 and

stated interest rates ranging from 2.38% to 6.88%.The Senior Unsecured

Notes represent senior, unsecured obligations and rank equally in right

of payment with all of our existing and future unsecured unsubordinated

indebtedness. Our Senior Unsecured Notes provide that the acceleration

of the maturity of any of our indebtedness in a principal amount in excess

of $50million will constitute a default under the Senior Unsecured Notes if

such acceleration is not annulled, or such indebtedness is not discharged,

within 30 days after notice.

During the third quarter of 2012 we repaid $263million of Senior Unsecured

Notes upon their maturity primarily with existing cash on hand.