Pizza Hut 2012 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 58

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

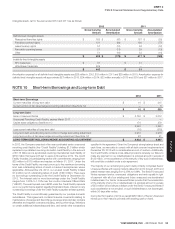

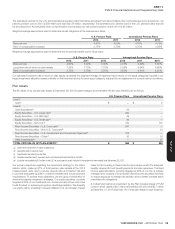

Information for pension plans with an accumulated benefi t obligation in excess of plan assets:

U.S. Pension Plans International Pension Plans

2012 2011 2012 2011

Projected benefi t obligation $ 1,290 $ 1,381 $ — $ —

Accumulated benefi t obligation 1,239 1,327 — —

Fair value of plan assets 945 998 — —

Information for pension plans with a projected benefi t obligation in excess of plan assets:

U.S. Pension Plans International Pension Plans

2012 2011 2012 2011

Projected benefi t obligation $ 1,290 $ 1,381 $ — $ 99

Accumulated benefi t obligation 1,239 1,327 — 87

Fair value of plan assets 945 998 — 87

Our funding policy with respect to the U.S. Plan is to contribute amounts

necessary to satisfy minimum pension funding requirements, including

requirements of the Pension Protection Act of 2006, plus such additional

amounts from time to time as are determined to be appropriate to improve

the U.S. Plan’s funded status.We currently do not plan to make any

contributions to the U.S. plan in 2013.

The funding rules for our pension plans outside of the U.S. vary from

country to country and depend on many factors including discount rates,

performance of plan assets, local laws and regulations.We do not plan

to make any signifi cant contributions to any pension plan outside of the

U.S. in 2013.

We do not anticipate any plan assets being returned to the Company

during 2013 for any plans.

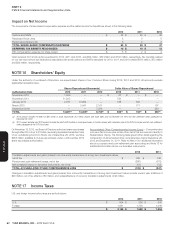

Components of net periodic benefi t cost:

Net periodic benefi t

cost

U.S. Pension Plans International Pension Plans

2012 2011 2010 2012 2011 2010

Service cost $ 26 $ 24 $ 25 $ 2 $ 5 $ 6

Interest cost 66 64 62 8 10 9

Amortization of prior

service cost(a) 1 1 1 — — —

Expected return on

plan assets (71) (71) (70) (11) (12) (9)

Amortization of net loss 63 31 23 1 2 2

NET PERIODIC

BENEFIT COST $ 85 $ 49 $ 41 $ — $ 5 $ 8

Additional loss

recognized due to:

Settlements(b) $ 89$ —$ 3$ —$ —$ —

Special termination

benefi ts(c) $3 $5 $1 $— $— $—

(a) Prior service costs are amortized on a straight-line basis over the average remaining service period of employees expected to receive benefits.

(b) Settlement losses result from benefit payments exceeding the sum of the service cost and interest cost for each plan during the year. See Note4 for discussion of the settlement payments

and settlement loss related to the U.S. Plan’s deferred vested benefit project.

(c) Special termination benefits primarily related to the U.S. business transformation measures taken in 2012, 2011 and 2010.

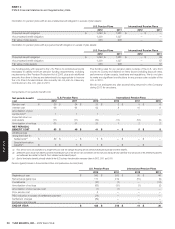

Pension (gains) losses in Accumulated other comprehensive income (loss):

U.S. Pension Plans International Pension Plans

2012 2011 2012 2011

Beginning of year $ 543 $ 363 $ 30 $ 46

Net actuarial (gain) loss 117 219 (15) (5)

Curtailments (10) (7) — (10)

Amortization of net loss (63) (31) (1) (2)

Amortization of prior service cost (1) (1) — —

Prior service cost 5 — — —

PBO reduction in excess of settlement payment (74) — — —

Settlement charges (89) — — —

Exchange rate changes — — — 1

END OF YEAR $ 428 $ 543 $ 14 $ 30