Pizza Hut 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement 21

Proxy Statement

ITEM4 Re-Approval of YUM! Brands,Inc. LongTerm

Incentive Plan Performance Measures

(Item4ontheProxyCard)

What am I voting on?

A proposal to re-approve the material terms of the performance

measures available under the YUM! Brands,Inc. Long Term

Incentive Plan (“LTIP”), as required by the performance-based

compensation rules under Section 162(m) of the Internal Revenue

Code (“Section 162(m)”).

IMPORTANT: This proposal does not seek to increase the

number of shares of common stock that may be issued under

the LTIP or to amend any performance objectives or other

existing provisions under the LTIP, and approval will not result

in any additional cost to the Company.

Why am I voting on this?

To preserve the Company’s ability to grant performance-based

compensation awards under the LTIP which may be exempt from

Section 162(m)’s $1million limit on tax deductible compensation.

If shareholders do not approve the proposal, the Company will

thereafter be unable to structure awards (other than options and

stock appreciation rights) that may be exempt from Section 162(m)’s

$1million limit on tax deductible compensation. It is important

to note that we reserve the right to make awards under the LTIP

(and otherwise) that may not be deductible, in whole or in part,

under Section 162(m).

Generally, Section 162(m) limits the deductibility of compensation

paid to the Company’s Chief Executive Offi cer and three additional

most highly compensated employees, other than the Chief

Financial Offi cer, to $1million per year. This limit does not apply,

however, to compensation that qualifi es as performance-based

compensation within the meaning of Section 162(m) (sometimes

referred to as “qualifi ed performance-based compensation”).

One of the requirements that must be met in order to satisfy the

qualifi ed performance-based compensation exception is that the

material terms of the performance measures that would apply to

compensation that is intended to be qualifi ed performance-based

compensation must be disclosed to and approved by the Company’s

shareholders at least once every fi ve years. Shareholder approval

is only one of several requirements under Section 162(m) which

must be met in order to satisfy the qualifi ed performance-based

compensation exception. Even if our shareholders approve the

proposal, there is no guarantee that awards granted under the

LTIP will be treated as qualifi ed performance- based compensation

and we reserve the right to make awards of compensation that

do not qualify for the qualifi ed performance-based compensation

exception of Section 162(m) (whether under the LTIP or otherwise).

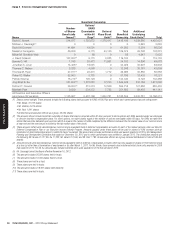

What are the material terms that must be approved?

For purposes of Section 162(m), the material terms include: (i) the

individuals eligible to receive compensation; (ii) a description of

the business criteria on which the performance goal is based; and

(iii) the maximum amount of compensation that can be paid to an

individual under the performance measure. Disclosure regarding

each of these material terms is included in the summary of the

LTIP below and is qualifi ed in its entirety by reference to the full

text of the LTIP set forth on Appendix A of this proxy statement.

Summary of the LTIP

Plan Administration. The LTIP is administered by a committee

(the “Committee”) selected by the Board and consisting solely of

two or more outside members of the Board. If the Committee does

not exist, or for any other reason determined by the Board, the

Board may take any action under the LTIP that would otherwise

be the responsibility of the Committee. The Management Planning

and Development Committee of the Company’s Board currently

serves as the Committee under the LTIP.

Committee Authority. The Committee has the authority and

discretion to select from among the eligible individuals those persons

who shall receive awards, to determine the time or times of receipt,

to determine the types of awards and the number of shares covered

by the awards, to establish the terms, conditions, performance

criteria, restrictions, and other provisions of such awards, and

subject to certain limits, to cancel or suspend awards. To the extent

that the Committee determines that the restrictions imposed by

the LTIP preclude the achievement of the material purposes of the