Pizza Hut 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 68

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

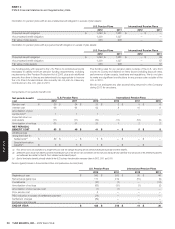

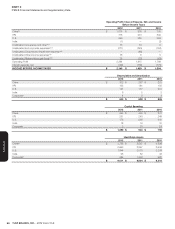

The following table summarizes the 2012 and 2011 activity related to our self-insured property and casualty reserves as of December29, 2012.

Beginning Balance Expense Payments Ending Balance

2012 Activity $ 140 58 (56) $ 142

2011 Activity $ 150 55 (65) $ 140

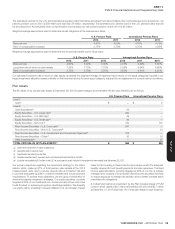

In the U.S. and in certain other countries, we are also self-insured for

healthcare claims and long-term disability for eligible participating employees

subject to certain deductibles and limitations.We have accounted for our

retained liabilities for property and casualty losses, healthcare and long-term

disability claims, including reported and incurred but not reported claims,

based on information provided by independent actuaries.

Due to the inherent volatility of actuarially determined property and casualty

loss estimates, it is reasonably possible that we could experience changes

in estimated losses which could be material to our growth in quarterly

and annual Net income.We believe that we have recorded reserves for

property and casualty losses at a level which has substantially mitigated

the potential negative impact of adverse developments and/or volatility.

Legal Proceedings

We are subject to various claims and contingencies related to lawsuits, real

estate, environmental and other matters arising in the normal course of

business. An accrual is recorded with respect to claims or contingencies

for which a loss is determined to be probable and reasonably estimable.

Beginning on January24, 2013 four purported class actions were fi led in

the United States District Court for the Central District of California against

the Company and certain of its executive offi cers. The complaints allege

claims under sections10(b) and 20(a) of the Securities Exchange Act of

1934 against defendants on behalf of a purported class of all persons

who purchased or otherwise acquired the Company’s publicly traded

securities between October9, 2012 and January7, 2013, inclusive (the

“class period”). Plaintiffs allege that during the class period, defendants

purportedly made materially false and misleading statements concerning

the Company’s current and future business and fi nancial condition, thereby

infl ating the prices at which the Company’s securities traded. The complaints

seek damages in an undefi ned amount. The Company denies liability

and intends to vigorously defend against all claims in these complaints.

However, in view of the inherent uncertainties of litigation, the outcome of

this case cannot be predicted at this time. Likewise, the amount of any

potential loss cannot be reasonably estimated.

On January24, 2013, a purported shareholder of the Company submitted

a letter demandingthat the board of directors initiate an investigation of

alleged breaches of fi duciary duties by directors, offi cers and employees of

the Company. The breaches of fi duciary duties are alleged to have arisen

as a result of, among other alleged misconduct, the failure to implement

proper controls in connectionwith the Company’s purchases of poultry

from suppliers to the Company’s China operations.On February8, 2013,

another purported shareholder of the Company fi led a derivative action in

the United States District Court for the Central District of California against

various offi cers and directors of the Company asserting breaches of fi duciary

duty in connection with an alleged scheme to mislead investors about the

Company’s growth prospects in China.The shareholder plaintiff did not

fi rst submit a demand on the board of directors of the Company to bring

this action as required under North Carolina law, and on February13, 2013

the shareholder plaintiff requested voluntary dismissal of the complaint.

The parties are awaiting the court’s approval of this request.

Taco Bell was named as a defendant in a number of putative class action

suits fi led in 2007, 2008, 2009 and 2010 alleging violations of California

labor laws including unpaid overtime, failure to timely pay wages on

termination, failure to pay accrued vacation wages, failure to pay minimum

wage, denial of meal and rest breaks, improper wage statements, unpaid

business expenses, wrongful termination, discrimination, conversion and

unfair or unlawful business practices in violation of California Business &

Professions Code §17200. Some plaintiffs also seek penalties for alleged

violations of California’s Labor Code under California’s Private Attorneys

General Act as well as statutory “waiting time” penalties and allege violations

of California’s Unfair Business Practices Act. Plaintiffs seek to represent a

California state-wide class of hourly employees.

On May19, 2009 the court granted Taco Bell’s motion to consolidate

these matters, and the consolidated case is styled In Re Taco Bell Wage

and Hour Actions. The In Re Taco Bell Wage and Hour Actions plaintiffs

fi led a consolidated complaint in June2009, and in March2010 the

court approved the parties’ stipulation to dismiss the Company from the

action. Plaintiffs fi led their motion for class certifi cation on the vacation

and fi nal pay claims in December2010, and on September26, 2011 the

court issued its order denying the certifi cation of the vacation and fi nal

pay claims. Plaintiffs then sought to certify four separate meal and rest

break classes. On January2, 2013, the District Court rejected three of

the proposed classes but granted certifi cation with respect to the late

meal break class.

Taco Bell denies liability and intends to vigorously defend against all claims

in this lawsuit. However, in view of the inherent uncertainties of litigation,

the outcome of this case cannot be predicted at this time. Likewise, the

amount of any potential loss cannot be reasonably estimated.

On September28, 2009, a putative class action styled Marisela Rosales

v. Taco Bell Corp. was fi led in Orange County Superior Court. The plaintiff,

a former Taco Bell crew member, alleges that Taco Bell failed to timely

pay her fi nal wages upon termination and seeks restitution and late

payment penalties on behalf of herself and similarly situated employees.

This case appears to be duplicative of the In Re Taco Bell Wage and

Hour Actions case described above. Taco Bell fi led a motion to dismiss,

stay or transfer the case to the same district court as the In Re Taco Bell

Wage and Hour Actions case. The state court granted Taco Bell’s motion

to stay the Rosales case on May28, 2010. After the September2011

denial of class certifi cation in the In Re Taco Bell Wage and Hour Actions,

the court granted plaintiff leave to amend her lawsuit, which plaintiff fi led

and served on January4, 2012. Taco Bell fi led its responsive pleading

on February8, 2012, and plaintiff has since fi led two additional amended

complaints. Taco Bell has answered the Third Amended Complaint and

commenced discovery.

Taco Bell denies liability and intends to vigorously defend against all claims

in this lawsuit. However, in view of the inherent uncertainties of litigation,

the outcome of this case cannot be predicted at this time. Likewise, the

amount of any potential loss cannot be reasonably estimated.

On December17, 2002, Taco Bell was named as the defendant in a class

action lawsuit fi led in the United States District Court for the Northern

District of California styled Moeller, et al. v. Taco Bell Corp. On August4,

2003, plaintiffs fi led an amended complaint alleging, among other things,

that Taco Bell has discriminated against the class of people who use

wheelchairs or scooters for mobility by failing to make its approximately

200 Company-owned restaurants in California accessible to the class.

Plaintiffs contend that queue rails and other architectural and structural

elements of the Taco Bell restaurants relating to the path of travel and use

of the facilities by persons with mobility-related disabilities do not comply

with the U.S. Americans with Disabilities Act (the “ADA”), the Unruh Civil

Rights Act (the “Unruh Act”), and the California Disabled Persons Act

(the “CDPA”). Plaintiffs have requested: (a) an injunction from the District

Court ordering Taco Bell to comply with the ADA and its implementing

regulations; (b) that the District Court declare Taco Bell in violation of the