Pizza Hut 2012 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 52

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

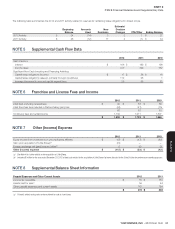

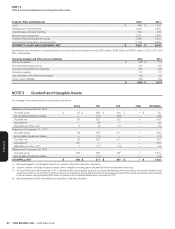

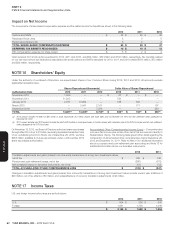

Property, Plant and Equipment 2012 2011

Land $ 469 $ 527

Buildings and improvements 4,093 3,856

Capital leases, primarily buildings 200 316

Machinery and equipment 2,627 2,568

Property, Plant and equipment, gross 7,389 7,267

Accumulated depreciation and amortization (3,139) (3,225)

PROPERTY, PLANT AND EQUIPMENT, NET $ 4,250 $ 4,042

Depreciation and amortization expense related to property, plant and equipment was $629million, $599million and $565million in 2012, 2011 and

2010, respectively.

Accounts Payable and Other Current Liabilities 2012 2011

Accounts payable $ 684 $ 712

Accrued capital expenditures 264 229

Accrued compensation and benefi ts 487 440

Dividends payable 151 131

Accrued taxes, other than income taxes 103 112

Other current liabilities 256 250

$ 1,945 $ 1,874

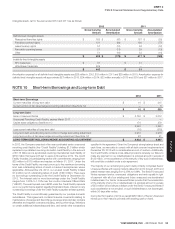

NOTE9 Goodwill and Intangible Assets

The changes in the carrying amount of goodwill are as follows:

China YRI U.S. India Worldwide

Balance as of December25, 2010

Goodwill, gross $ 85 $ 269 $ 348 $ — $ 702

Accumulated impairment losses — (17) (26) — (43)

Goodwill, net 85 252 322 — 659

Acquisitions(a) — 32 — — 32

Disposals and other, net(b) 3 (2) (11) — (10)

Balance as of December31, 2011(c)

Goodwill, gross 88 299 311 — 698

Accumulated impairment losses — (17) — — (17)

Goodwill, net 88 282 311 — 681

Acquisitions(d) 376 — — — 376

Disposals and other, net(b) 2 (11) (14) — (23)

Balance as of December29, 2012

Goodwill, gross 466 288 297 — 1,051

Accumulated impairment losses — (17) — — (17)

GOODWILL, NET $ 466 $ 271 $ 297 $ — $ 1,034

(a) We recorded goodwill in our YRI segment related to the acquisition of 68 stores in South Africa. See Note4.

(b) Disposals and other, net includes the impact of foreign currency translation on existing balances and goodwill write-offs associated with refranchising.

(c) As a result of the LJS and A&W divestitures in 2011, we disposed of $26million of goodwill assigned to our LJS and A&W reporting unit that was previously fully impaired. Goodwill that was

assigned to our KFC U.S. and Taco Bell U.S. reporting units upon the acquisition of LJS and A&W and that has not been previously included in the carrying amounts of restaurants disposed

of was not impaired, totals approximately $130million and remains on our Consolidated Balance Sheet at December29, 2012.

(d) We recorded goodwill of $376million related to our acquisition of Little Sheep. See Note4.