Pizza Hut 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement34

Proxy Statement

EXECUTIVE COMPENSATION

•Compensation recovery (i.e., “clawback”)

•Limit on future severance agreements

•

Double trigger vesting of equity awards upon change in control

•No employment agreements

•No re-pricing of stock appreciation rights or stock options

•No excise tax gross-ups upon change in control

•No hedging or pledging of Company stock

•

No inclusion of the value of equity awards in pension calculations

•No tax gross-ups

•

Independent compensation consultant to advise Management

Planning and Development Committee

2012 Executive Compensation Program and Decisions

Our annual compensation program has three primary pay components:

•Base salary

•Annual performance-based cash bonuses

•Long-term equity performance-based incentives

Our target pay philosophy for these components as compared to

the market is (see page 35 for discussion on comparator group):

•

Chief Executive Offi cer total cash and total compensation at

the 75th percentile

•

Named Executive Offi cer base salary between the 50

th

and

75

th

percentile, bonus target at 75

th

percentile and long-term

incentives at the 50th percentile

The Committee reviews the pay mix at several specifi c companies

in our Executive Peer Group, and also considers the pay mix of the

Executive Peer Group as a whole.

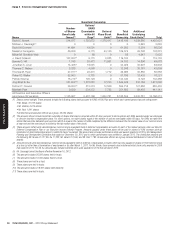

As the graph below shows, and consistent with our philosophy to reward performance, the performance-based bonus and equity incentives

constitute by far the largest portion of target direct compensation for our Named Executive Offi cers:

13%

21%

66%

CHIEF EXECUTIVE OFFICER TARGET PAY MIX—2012

21%

58%

21%

ALL OTHER NAMED EXECUTIVE OFFICERS TARGET PAY MIX—2012

Base Salary Annual Bonus

Long-Term Equity Incentive

Base Salary Annual Bonus Long-Term Equity Incentive

Details regarding compensation decisions follow.

How Compensation Decisions Are Made

Role of the Committee and Chief Executive Offi cer

In Januaryof each year, the Committee reviews the performance

and total compensation package of our Chief Executive Offi cer and

the other Named Executive Offi cers. The Committee reviews and

establishes each Named Executive Offi cers’ total compensation

target for the current year which includes base salary, annual bonus

opportunities and long-term incentive awards. The Committee’s

decisions impacting our Chief Executive Offi cer are also reviewed

and ratifi ed by the independent members of the Board.

In making these compensation decisions, the Committee relies on

the Chief Executive Offi cer’s in-depth review of the performance

of the other Named Executive Offi cers as well as competitive

market information. Compensation decisions are ultimately made

by the Committee using its judgment, focusing primarily on each

Named Executive Offi cer’s performance against his or her fi nancial

and strategic objectives, qualitative factors and the Company’s

overall performance. In making its decisions, the Committee also

consider s the total compensation of each Named Executive Offi cer

and retains discretion to make compensation decisions that are

refl ective of overall business performance.