Pizza Hut 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 27

Form 10-K

PART II

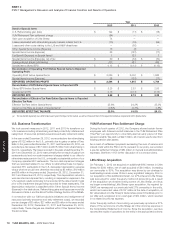

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

The increase in YRI G&A expenses for 2011 was driven by increased

investment in strategic growth markets, including the acquisition of our

Russia business in 2010, partially offset by G&A savings from refranchising

all of our remaining company restaurants in Mexico.

The increase in U.S. G&A expenses for 2012 was driven by higher pension

costs, incentive compensation costs and litigation costs, partially offset by

the LJS and A&W divestitures and our restaurant refranchising initiatives.

The decrease in U.S. G&A expenses for 2011 was driven by lapping of higher

litigation and incentive compensation costs in 2010 and G&A savings from

the actions taken as part of our U.S. business transformation measures.

The increase in Unallocated G&A expenses for 2012 was driven primarily

by higher pension costs, including the YUM Retirement Plan settlement

charge of $84million, partially offset by lapping costs related to the actions

taken as part of our U.S. business transformation measures, lower litigation

costs and costs related to the LJS and A&W divestitures in 2011.

The increase in Unallocated G&A expenses for 2011 was driven primarily

by actions taken as part of our U.S. business transformation measures

and costs related to the LJS and A&W divestitures.

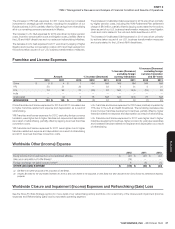

Franchise and License Expenses

Amount % Increase (Decrease)

% Increase (Decrease)

excluding foreign

currency translation

% Increase (Decrease)

excluding foreign

currency translation

and 53rd week

2012 2011 2010 2012 2011 2012 2011 2012 2011

China $ 9 $ 4 $ 1 NM NM NM NM NM NM

YRI 50 51 36 — 39 4 31 4 30

U.S. 74 92 70 (20) 32 N/A N/A (19) 32

India — — — — — — — — —

Unallocated — (2) 3 78 NM N/A N/A 78 NM

WORLDWIDE $ 133 $ 145 $ 110 (8) 32 (7) 30 (7) 29

China Franchise and license expenses for 2012 and 2011 increased due

to higher franchise-related rent expense and depreciation as a result of

refranchising.

YRI Franchise and license expenses for 2012, excluding foreign currency

translation, were higher due to higher franchise rent expense and depreciation

as a result of refranchising, partially offset by lapping bi-annual franchise

convention costs.

YRI Franchise and license expenses for 2011 were higher due to higher

franchise-related rent expense and depreciation as a result of refranchising

and 2011 bi-annual franchise convention costs.

U.S. Franchise and license expenses for 2012 were positively impacted by

15% due to the LJS and A&W divestitures. The remaining decrease was

driven by lower franchise development incentives, partially offset by higher

franchise-related rent expense and depreciation as a result of refranchising.

U.S. Franchise and license expenses for 2011 were higher due to higher

franchise development incentives, higher provision for past-due receivables

and increased franchise-related rent expense and depreciation as a result

of refranchising.

Worldwide Other (Income) Expense

2012 2011 2010

Equity income from investments in unconsolidated affi liates $ (47) $ (47) $ (42)

Gain upon acquisition of Little Sheep(a) (74) — —

Foreign exchange net (gain) loss and other(b) 6 (6) (1)

OTHER (INCOME) EXPENSE $ (115) $ (53) $ (43)

(a) See Note4 for further discussion of the acquisition of Little Sheep.

(b) Includes $6million for the year ended December29, 2012 of deal costs related to the acquisition of Little Sheep that were allocated to the China Division for performance reporting

purposes.

Worldwide Closure and Impairment (Income) Expenses and Refranchising (Gain) Loss

See the Store Portfolio Strategy section for more detail of our refranchising activity and Note4 for a summary of the Closure and impairment (income)

expenses and Refranchising (gain) loss by reportable operating segment.