Pizza Hut 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 49

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

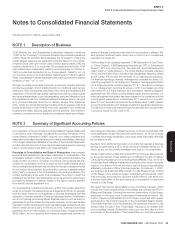

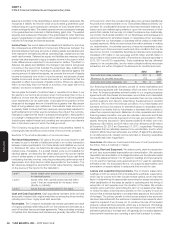

LJSand A&W Divestitures

In 2011 we sold the Long John Silver’s and A&W All American Food

Restaurants brands to key franchise leaders and strategic investors in

separate transactions.

We recognized $86million of pre-tax losses and other costs primarily in

Closures and impairment (income) expenses during 2011 as a result of

these transactions. Additionally, we recognized $104million of tax benefi ts

related to tax losses associated with the transactions.

We are not including the pre-tax losses and other costs in our U.S. and

YRI segments for performance reporting purposes as we do not believe

they are indicative of our ongoing operations. In 2012, System sales and

Franchise and license fees and income in the U.S. were negatively impacted

by 5% and 6%, respectively, due to these divestitures while YRI’s system

sales and Franchise and license fees and income were both negatively

impacted by 1%. While these divestitures negatively impacted both the

U.S. and YRI segments’ Operating Profi t by 1% in 2012, the impact on

our consolidated Operating Profi t was not signifi cant.

Little Sheep Acquisition

On February1, 2012 we acquired an additional 66% interest in Little Sheep

Group Limited (“Little Sheep”) for $540million, net of cash acquired of

$44million, increasing our ownership to 93%.The acquisition was driven

by our strategy to build leading brands across China in every signifi cant

category.Prior to our acquisition of this additional interest, our 27%

interest in Little Sheep was accounted for under the equity method of

accounting.As a result of the acquisition we obtained voting control of Little

Sheep, and thus we began consolidating Little Sheep upon acquisition.As

required by GAAP, we remeasured our previously held 27% ownership

in Little Sheep, which had a recorded value of $107million at the date

of acquisition, at fair value based on Little Sheep’s traded share price

immediately prior to our offer to purchase the business and recognized

a non-cash gain of $74million.This gain, which resulted in no related

income tax expense, was recorded in Other (income) expense on our

Consolidated Statement of Income and was not allocated to any segment

for performance reporting purposes.

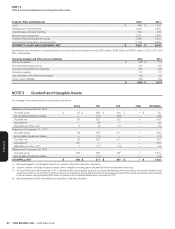

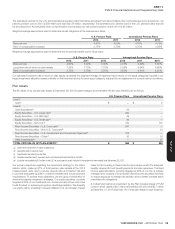

We recorded the following assets acquired and liabilities assumed upon

acquisition of Little Sheep as a result of our purchase price allocation:

Current assets, including cash of $44 $ 109

Property, plant and equipment 64

Goodwill 376

Intangible assets, including indefi nite-lived

trademark of $404 421

Other assets 35

Total assets acquired 1,005

Deferred taxes 105

Other liabilities 60

Total liabilities assumed 165

Redeemable noncontrolling interest 59

Other noncontrolling interests 16

NET ASSETS ACQUIRED $ 765

The fair values of intangible assets were determined using an income

approach based on expected cash fl ows. The goodwill recorded resulted

from the value expected to be generated from applying YUM’s processes

and knowledge in China, including YUM’s development capabilities, to

the Little Sheep business. The goodwill is not expected to be deductible

for income tax purposes and has been allocated to the China operating

segment.

As part of the acquisition, YUM granted an option to the shareholder that

holds the remaining 7% ownership interest in Little Sheep that would require

us to purchase their remaining shares owned upon exercise, which may occur

any time after the third anniversary of the acquisition. This noncontrolling

interest has been recorded as a Redeemable noncontrolling interest in the

Consolidated Balance Sheet. The Redeemable noncontrolling interest is

reported at its fair value of $59million at the date of acquisition, which is

based on the Little Sheep traded share price immediately subsequent to

our offer to purchase the additional interest.

Under the equity method of accounting, we previously reported our 27%

share of the net income of Little Sheep as Other (income) expense in the

Consolidated Statements of Income. From the date of the acquisition, we

have reported the results of operations for the entity in the appropriate line

items of our Consolidated Statement of Income.We no longer report Other

(income) expense as we did under the equity method of accounting.Net

income attributable to our partner’s ownership percentage is recorded as

Net Income - noncontrolling interest. Little Sheep reports on a one month

lag, and as a result, their consolidated results are included in the China

Division from the beginning of the quarter ended June16, 2012. In 2012,

the consolidation of Little Sheep increased China Division revenues by 4%

and did not have a signifi cant impact on China Division Operating Profi t.

The pro forma impact on our results of operations if the acquisition had been

completed as of the beginning of 2011 would not have been signifi cant.

YRI Acquisitions

In 2011, YRI acquired 68 KFC restaurants from an existing franchisee in

South Africa for $71million.

In 2010, we completed the exercise of our option with our Russian partner

to purchase their interest in the co-branded Rostik’s-KFC restaurants

across Russia and the Commonwealth of Independent States.As a result,

we acquired company ownership of 50 restaurants and gained full rights

and responsibilities as franchisor of 81 restaurants, which our partner

previously managed as master franchisee.We paid cash of $60million, net

of settlement of a long-term note receivable of $11million, and assumed

long-term debt of $10million which was subsequently repaid.Of the

remaining balance of the purchase price of $12million, a payment of

$9million was made in July2012 and the remainder is expected to be

paid in cash during 2013.

The impact of consolidating these businesses on all line-items within our

Consolidated Statement of Income was insignifi cant to the comparison

of our year-over-year results.