Pizza Hut 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172

|

|

YUM! BRANDS, INC.-2013Proxy Statement 31

Proxy Statement

EXECUTIVE COMPENSATION

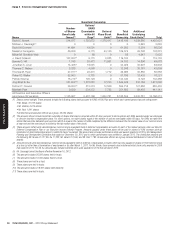

The success of our strategy is evidenced by our consistent year-over-year EPS growth and the related increase in our stock price and

Total Shareholder Return (“TSR”) over the past ten years.

EARNINGS PER SHARE* - TEN YEAR GROWTH

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

$10.43

$66.06

+534% Total

Shareholder

Return

2012

13% 13%

15%

13%

14%

15%

14%

13%

17%

14%

13%

*For purposes of calculating the year-over-year growth in EPS in the chart above, EPS excludes special items believed to be distortive of consolidated results on a

year-over-year basis and the initial impact of expensing stock options in 2005. The special items excluded are the same as those excluded in the Company’s annual

earnings releases. EPS growth is calculated based on YUM ’s fi scal year end which ends the last Saturday of each calendar year. The total shareholder return refl ects

a calendar year end of December 31, 20 12.

In addition to EPS growth, our strategy’s success is demonstrated by our one-, three-, fi ve- and ten-year results for TSR as compared

to our executive compensation peer group (“Executive Peer Group”) and the S&P 500. Consistently strong total shareholder return,

especially over the long term, means not only are we creating value for shareholders but our superior relative results suggests we are

exceeding shareholder expectations compared to the market generally.