Pizza Hut 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172

|

|

YUM! BRANDS, INC.-2013Proxy Statement 57

Proxy Statement

EXECUTIVE COMPENSATION

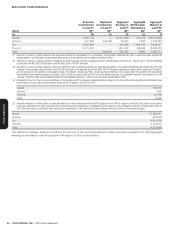

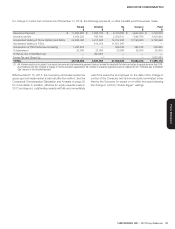

If a change in control had occurred as of December31,2012, the following payments, or other benefi ts would have been made.

Novak

$

Grismer

$

Su

$

Carucci

$

Pant

$

Severance Payment $ 11,982,800 $ 1,982,180 $ 8,410,000 $ 4,932,000 $ 3,720,076

Annual Incentive 4,584,320 760,760 2,039,813 1,846,785 1,620,000

Accelerated Vesting of Stock Options and SARs 22,865,360 3,231,648 14,702,490 12,190,085 9,793,696

Accelerated Vesting of RSUs — 614,319 11,931,947 — —

Acceleration of PSU Performance/Vesting 1,250,912 — 546,784 390,748 302,920

Outplacement 25,000 25,000 25,000 25,000 25,000

Forfeiture due to Modifi ed Cap — (62,357) — — —

Excise Tax and Gross-Up — —(1) — — 1,933,480

TOTAL 40,708,392 6,551,550 37,656,034 19,384,618 17,395,172

(1) Mr.Grismer would not be subject to an excise tax since his total severance payment does not exceed the threshold for which excise tax is payable by more than 10%.

In accordance with the Company’s change in control severance agreements, Mr.Grismer’s severance payment would be reduced by the “Forfeiture due to Modified

Cap” amount to the threshold amount.

Effective March15,2013, the Company eliminated excise tax

gross-ups and implemented a best net after-tax method. See the

Company’s Compensation Discussion and Analysis on page 30

for more detail. In addition, effective for equity awards made in

2013 and beyond, outstanding awards will fully and immediately

vest if the executive is employed on the date of the change in

control of the Company and is is involuntarily terminated (other

than by the Company for cause) on or within two years following

the change in control (“double trigger” vesting).