Pizza Hut 2012 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 70

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

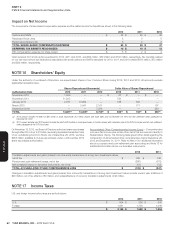

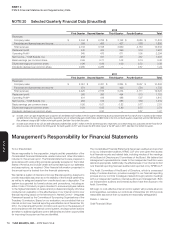

NOTE20 Selected Quarterly Financial Data (Unaudited)

2012

First Quarter Second Quarter Third Quarter Fourth Quarter Total

Revenues:

Company sales $ 2,344 $ 2,762 $ 3,142 $ 3,585 $ 11,833

Franchise and license fees and income 399 406 427 568 1,800

Total revenues 2,743 3,168 3,569 4,153 13,633

Restaurant profi t 440 423 599 519 1,981

Operating Profi t(a) 645 473 671 505 2,294

Net Income – YUM! Brands, Inc. 458 331 471 337 1,597

Basic earnings per common share 0.99 0.71 1.02 0.74 3.46

Diluted earnings per common share 0.96 0.69 1.00 0.72 3.38

Dividends declared per common share 0.285 0.285 — 0.67 1.24

2011

First Quarter Second Quarter Third Quarter Fourth Quarter Total

Revenues:

Company sales $ 2,051 $ 2,431 $ 2,854 $ 3,557 $ 10,893

Franchise and license fees and income 374 385 420 554 1,733

Total revenues 2,425 2,816 3,274 4,111 12,626

Restaurant profi t 360 386 494 513 1,753

Operating Profi t(b) 401 419 488 507 1,815

Net Income – YUM! Brands, Inc. 264 316 383 356 1,319

Basic earnings per common share 0.56 0.67 0.82 0.77 2.81

Diluted earnings per common share 0.54 0.65 0.80 0.75 2.74

Dividends declared per common share — 0.50 — 0.57 1.07

(a) Includes a non-cash gain recognized upon acquisition of Little Sheep of $74million in the first quarter, refranchising losses associated with the Pizza Hut UK dine-in business of $24million

and $46million in the first and fourth quarters, respectively, net U.S. refranchising gains of $45million and $69million in the first and fourth quarters, respectively and the YUM Retirement

Plan settlement charge of $84million in the fourth quarter. See Note4 for further discussion.

(b) Includes losses related to the LJS and A&W divestitures of $68million and $17million in the first and third quarters, respectively and a refranchising loss associated with the Pizza Hut UK

dine-in business of $76million in the third quarter. The fourth quarter of 2011 also includes the $25million impact of the 53rd week in 2011. See Note4 for further discussion.

Management’s Responsibility for Financial Statements

To Our Shareholders:

We are responsible for the preparation, integrity and fair presentation of the

Consolidated Financial Statements, related notes and other information

included in this annual report.The fi nancial statements were prepared in

accordance with accounting principles generally accepted in the United

States of America and include certain amounts based upon our estimates

and assumptions, as required.Other fi nancial information presented in

the annual report is derived from the fi nancial statements.

We maintain a system of internal control over fi nancial reporting, designed to

provide reasonable assurance as to the reliability of the fi nancial statements,

as well as to safeguard assets from unauthorized use or disposition.The

system is supported by formal policies and procedures, including an

active Code of Conduct program intended to ensure employees adhere

to the highest standards of personal and professional integrity.We have

conducted an evaluation of the effectiveness of our internal control over

fi nancial reporting based on the framework in Internal Control – Integrated

Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission.Based on our evaluation, we concluded that our

internal control over fi nancial reporting was effective as of December29,

2012.Our internal audit function monitors and reports on the adequacy of

and compliance with the internal control system, and appropriate actions

are taken to address signifi cant control defi ciencies and other opportunities

for improving the system as they are identifi ed.

The Consolidated Financial Statements have been audited and reported

on by our independent auditors, KPMG LLP, who were given free access

to all fi nancial records and related data, including minutes of the meetings

of the Board of Directors and Committees of the Board.We believe that

management representations made to the independent auditors were

valid and appropriate.Additionally, the effectiveness of our internal control

over fi nancial reporting has been audited and reported on by KPMG LLP.

The Audit Committee of the Board of Directors, which is composed

solely of outside directors, provides oversight to our fi nancial reporting

process and our controls to safeguard assets through periodic meetings

with our independent auditors, internal auditors and management.Both

our independent auditors and internal auditors have free access to the

Audit Committee.

Although no cost-effective internal control system will preclude all errors

and irregularities, we believe our controls as of December29, 2012 provide

reasonable assurance that our assets are reasonably safeguarded.

Patrick J. Grismer

Chief Financial Offi cer