Pizza Hut 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 57

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

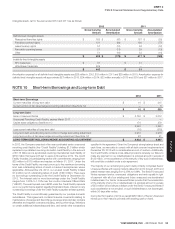

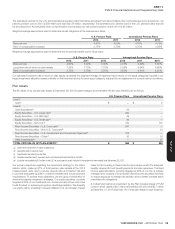

Obligation and Funded Status at Measurement Date:

The following chart summarizes the balance sheet impact, as well as benefi t obligations, assets, and funded status associated with our U.S. pension

plans and signifi cant International pension plans.The actuarial valuations for all plans refl ect measurement dates coinciding with our fi scal year ends.

U.S. Pension Plans International Pension Plans

2012 2011 2012 2011

Change in benefi t obligation

Benefi t obligation at beginning of year $ 1,381 $ 1,108 $ 187 $ 187

Service cost 26 24 2 5

Interest cost 66 64 8 10

Participant contributions — — 1 1

Plan amendments 5 — — —

Curtailments (10) (7) — (10)

PBO reduction in excess of settlement payments (74) — — —

Special termination benefi ts 3 5 — —

Exchange rate changes — — 5 1

Benefi ts paid (14) (11) (4) (2)

Settlement payments(a) (278) (29) — —

Actuarial (gain) loss 185 227 (6) (5)

Benefi t obligation at end of year $ 1,290 $ 1,381 $ 193 $ 187

Change in plan assets

Fair value of plan assets at beginning of year $ 998 $ 907 $ 183 $ 164

Actual return on plan assets 144 83 21 10

Employer contributions 100 53 19 10

Participant contributions — — 1 1

Settlement payments(a) (278) (29) — —

Benefi ts paid (14) (11) (4) (2)

Exchange rate changes — — 6 —

Administrative expenses (5) (5) — —

Fair value of plan assets at end of year $ 945 $ 998 $ 226 $ 183

FUNDED STATUS AT END OF YEAR $ (345) $ (383) $ 33 $ (4)

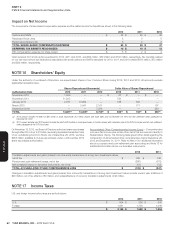

Amounts recognized in the Consolidated Balance Sheet:

U.S. Pension Plans International Pension Plans

2012 2011 2012 2011

Prepaid benefi t asset - non-current $ — $ — $ 33 $ 8

Accrued benefi t liability – current (19) (14) — —

Accrued benefi t liability – non-current (326) (369) — (12)

$ (345) $ (383) $ 33 $ (4)

Losses recognized in Accumulated Other Comprehensive Income:

U.S. Pension Plans International Pension Plans

2012 2011 2012 2011

Actuarial net loss $ 421 $ 540 $ 14 $ 30

Prior service cost 7 3 — —

$ 428 $ 543 $ 14 $ 30

(a) See Note4 for discussion of the settlement payments and settlement loss related to the U.S. Plan’s deferred vested benefit program.

The accumulated benefi t obligation for the U.S. and International pension plans was $1,426million and $1,496million at December29, 2012 and

December31, 2011, respectively.