Pizza Hut 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

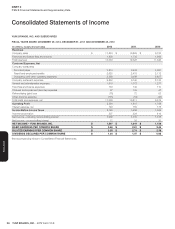

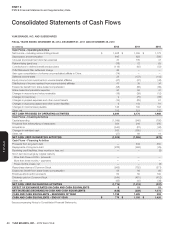

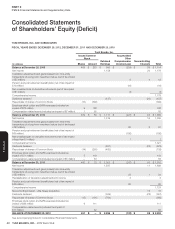

YUM! BRANDS, INC.-2012 Form10-K 48

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

instruments not designated as hedging instruments, the gain or loss is

recognized in the results of operations immediately.See Note12 for a

discussion of our use of derivative instruments, management of credit risk

inherent in derivative instruments and fair value information.

Common Stock Share Repurchases.From time to time, we repurchase

shares of our Common Stock under share repurchase programs authorized

by our Board of Directors.Shares repurchased constitute authorized,

but unissued shares under the North Carolina laws under which we

are incorporated.Additionally, our Common Stock has no par or stated

value.Accordingly, we record the full value of share repurchases, upon the

trade date, against Common Stock on our Consolidated Balance Sheet

except when to do so would result in a negative balance in such Common

Stock account.In such instances, on a period basis, we record the cost

of any further share repurchases as a reduction in retained earnings.Due

to the large number of share repurchases and the increase in the market

value of our stock over the past several years, our Common Stock balance

is frequently zero at the end of any period.Accordingly, $794million and

$483million in share repurchases were recorded as a reduction in Retained

Earnings in 2012 and 2011, respectively. Our Common Stock balance was

such that no share repurchases impacted Retained Earnings in 2010.See

Note16 for additional information.

Pension and Post-retirement Medical Benefi ts.We measure and recognize

the overfunded or underfunded status of our pension and post-retirement

plans as an asset or liability in our Consolidated Balance Sheet as of our

fi scal year end.The funded status represents the difference between

the projected benefi t obligations and the fair value of plan assets.The

projected benefi t obligation is the present value of benefi ts earned to

date by plan participants, including the effect of future salary increases,

as applicable.The difference between the projected benefi t obligations

and the fair value of plan assets that has not previously been recognized

in our Consolidated Statement of Income is recorded as a component of

Accumulated other comprehensive income (loss).

We recognize settlement gains or losses only when the cost of all settlements

in a year exceeds the sum of the service and interest costs within an

individual plan.

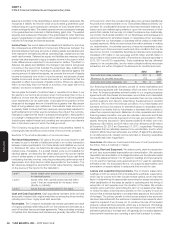

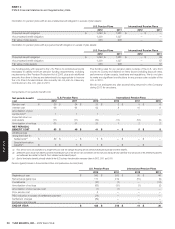

NOTE3 Earnings Per Common Share (“EPS”)

2012 2011 2010

NET INCOME – YUM! BRANDS, INC. $ 1,597 $ 1,319 $ 1,158

Weighted-average common shares outstanding (for basic calculation) 461 469 474

Effect of dilutive share-based employee compensation 12 12 12

WEIGHTED-AVERAGE COMMON AND DILUTIVE POTENTIAL COMMON SHARES

OUTSTANDING (FOR DILUTED CALCULATION) 473 481 486

BASIC EPS $ 3.46 $ 2.81 $ 2.44

DILUTED EPS $ 3.38 $ 2.74 $ 2.38

UNEXERCISED EMPLOYEE STOCK OPTIONS AND STOCK APPRECIATION

RIGHTS (IN MILLIONS) EXCLUDED FROM THE DILUTED EPS COMPUTATION(a) 3.1 4.2 2.2

(a) These unexercised employee stock options and stock appreciation rights were not included in the computation of diluted EPS because to do so would have been antidilutive for the periods

presented.

NOTE4 Items Affecting Comparability of Net Income and Cash Flows

U.S. Business Transformation

As part of our plan to transform our U.S. business we took several measures

in 2012, 2011 and 2010 (“the U.S. business transformation measures”).

These measures included: continuation of our U.S. refranchising; General

and Administrative (“G&A”) productivity initiatives and realignment of

resources (primarily severance and early retirement costs).

For information on our U.S. refranchising, see the Refranchising (Gain)

Loss section on page 50 .

In connection with our G&A productivity initiatives and realignment of

resources (primarily severance and early retirement costs), we recorded

pre-tax charges of $5million, $21million and $9million in the years

ended December29, 2012, December31, 2011 and December25,

2010, respectively.The unpaid current liability for the severance portion

of these charges was $5million and $18million as of December29, 2012

and December31, 2011, respectively.Severance payments in the years

ended December29, 2012, December31, 2011 and December25, 2010

totaled approximately $14million, $4million and $7million respectively.

We are not including the impacts of these U.S. business transformation

measures in our U.S. segment for performance reporting purposes as we

do not believe they are indicative of our ongoing operations.Additionally,

we did not include the depreciation reduction of $3million, $10million and

$9million for the years ended December29, 2012, December31, 2011

and December25, 2010, respectively, arising from the impairment of the

KFCs offered for sale in the year ended December25, 2010 within our U.S.

segment for performance reporting purposes.Rather, we recorded such

reduction as a credit within unallocated Occupancy and other operating

expenses resulting in depreciation expense for the impaired restaurants

we continued to own being recorded in the U.S. segment at the rate at

which it was prior to the impairment charge being recorded.

YUM Retirement Plan Settlement Charge

During the fourth quarter of 2012, the Company allowed certain former

employees with deferred vested balances in the YUM Retirement Plan

(“the Plan”) an opportunity to voluntarily elect an early payout of their

pension benefi ts. We paid out $227million, all of which was funded from

existing pension plan assets.

As a result of settlement payments exceeding the sum of service and

interest costs within the Plan, pursuant to our policy, we recorded a pre-tax

settlement charge of $84million in General and administrative expenses in

the fourth quarter of 2012 which was not allocated for segment reporting

purposes. See Note14 for further discussion of our pension plans.