Pizza Hut 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

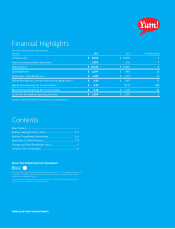

13%

EPS Growth*

+5%

System Sales Growth**

$1.6 billion

Net Income

+18%

Increased Dividend

$1.34

Annual Dividend

Per Share Rate

+1,976

Units***

David C. Novak

Chairman & Chief Executive Officer,

Yum! Brands, Inc.

*Excluding special items

**Prior to foreign currency translation

***Outside the U.S.

Dear Partners,

I’m pleased to report that in 2012 we delivered full-year EPS

growth of 13% or $3.25 per share, excluding special items,

marking the eleventh consecutive year we achieved at least

13% and exceeded our annual target of at least 10%. This kind

of consistent performance puts us in an elite group of high-

growth companies.

We set a new record for international development by opening

nearly 2,000 new restaurants in 2012. We also grew worldwide

system sales 5% and operating profit 12%, both prior to foreign

currency translation and special items. We generated $1.6 billion

in net income and almost $2.3 billion in cash from operations. And

with our disciplined approach to capital deployment, we remained

an industry leader with a Return on Invested Capital of 22%. Our

strong cash flow generation allowed us to increase our dividend

rate 18%, to an annual rate of $1.34 per share. Our share price

increased 13% for the full year, on top of 20% in 2011. Looking

back, we are extremely proud that our five year average annual

shareholder return, including stock appreciation and dividend

reinvestment, is 14% versus the S&P 500 average of 2%.

We are proud of our track record of consistency which we believe

is a result of getting better and better at executing the same

growth strategies we identified over a decade ago. So as tempting

as it might be to unveil some new revolutionary thinking that will

drive our company’s growth, I have to admit my message this year

might be a bit boring: we’re simply going to STAY THE COURSE

with our strategies to build the defining global company that feeds

the world.

Yet when I step back and think about it, I’ve

concluded and hope you agree, staying the course

is actually good news for you as a long-term

shareholder. For you see, we don’t have to dream

up a dramatic new approach or totally revamp our

business model because the strategies we have

are working.

1