Pizza Hut 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 21

Form 10-K

PART II

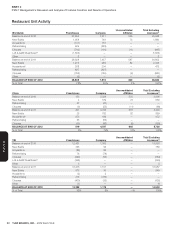

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

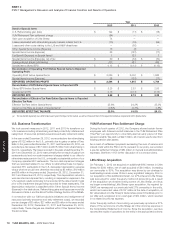

The following table summarizes the impact of refranchising on Total revenues as described above:

2012

China YRI U.S. India Worldwide

Decreased Company sales $ (54 ) $ (113) $ (606) $ — $ (773)

Increased Franchise and license fees

andincome 9 10 43 — 62

DECREASE IN TOTAL REVENUES $ (45) $ (103) $ (563) $ — $ (711)

2011

China YRI U.S. India Worldwide

Decreased Company sales $ (36) $ (311) $ (404) $ — $ (751)

Increased Franchise and license fees

andincome 6 25 27 — 58

DECREASE IN TOTAL REVENUES $ (30) $ (286) $ (377) $ — $ (693)

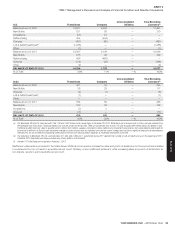

The following table summarizes the impact of refranchising on Operating Profi t as described above:

2012

China YRI U.S. India Worldwide

Decreased Restaurant profi t $ (8) $ (7) $ (46) $ — $ (61)

Increased Franchise and license fees

andincome 9 10 43 — 62

Increased Franchise and license expenses (4) (4) (6) — (14)

Decreased G&A — 2 12 — 14

INCREASE (DECREASE) IN OPERATING

PROFIT $ (3) $ 1 $ 3 $ — $ 1

2011

China YRI U.S. India Worldwide

Decreased Restaurant profi t $ (5) $ (25) $ (43) $ — $ (73)

Increased Franchise and license fees

and income 6 25 27 — 58

Increased Franchise and license expenses (2) (2) (2) — (6)

Decreased G&A — 21 6 — 27

INCREASE (DECREASE) IN OPERATING

PROFIT $ (1) $ 19 $ (12) $ — $ 6

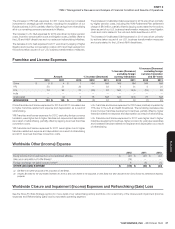

Internal Revenue Service Proposed

Adjustments

On June23, 2010, the Company received a Revenue Agent Report (RAR)

from the Internal Revenue Service (the “IRS”) relating to its examination

of our U.S. federal income tax returns for fi scal years 2004 through

2006.The IRS has proposed an adjustment to increase the taxable value

of rights to intangibles used outside the U.S. that YUM transferred to

certain of its foreign subsidiaries.The proposed adjustment would result

in approximately $700million of additional taxes plus net interest to date

of approximately $220million for fi scal years 2004-2006.On January9,

2013, the Company received an RAR from the IRS for fi scal years 2007

and 2008. As expected, the IRS proposed an adjustment similar to their

proposal for 2004-2006 that would result in approximately $270million of

additional taxes plus net interest to date of approximately $30million for

fi scal years 2007 and 2008. Furthermore, the Company expects the IRS

to make similar claims for years subsequent to fi scal 2008. The potential

additional taxes for 2009 through 2012, computed on a similar basis to

the 2004-2008 additional taxes, would be approximately $130million plus

net interest to date of approximately $5million.

We believe that the Company has properly reported taxable income and

paid taxes in accordance with applicable laws and that the proposed

adjustments are inconsistent with applicable income tax laws, Treasury

Regulations and relevant case law.We intend to defend our position

vigorously and have fi led a protest with the IRS.As the fi nal resolution of

the proposed adjustments remains uncertain, the Company will continue

to provide for its position in accordance with GAAP. There can be no

assurance that payments due upon fi nal resolution of this issue will not

exceed our currently recorded reserve and such payments could have a

material, adverse effect on our fi nancial position.Additionally, if increases

to our reserves are deemed necessary due to future developments related

to this issue, such increases could have a material, adverse effect on

our results of operations as they are recorded.The Company does not

expect resolution of this matter within twelve months and cannot predict

with certainty the timing of such resolution.

China Value Added Tax Regulation

A tax regulation was issued in November2011 in China which addresses

the imposition of a Value Added Tax on certain food sales where the food

is not consumed on the premises where sold.The applicability of the

regulation, if any, to the sales under certain of our restaurant distribution

methods is unclear at this time. While we do not anticipate that the

regulation will have a material impact on our results of operations or cash

fl ows, we currently cannot quantify the potential impact, if any, until we

have further clarity as to its applicability.