Pizza Hut 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 26

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

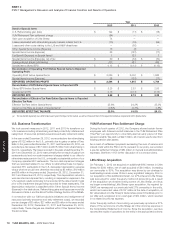

Income/(Expense)

2011 vs. 2010

2010

Store Portfolio

Actions Other

53rd Week in

2011 2011

Company sales $ 3,355 $ (322) $ (76) $ 43 $ 3,000

Cost of sales (976) 95 (23) (13) (917)

Cost of labor (994) 101 (7) (12) (912)

Occupancy and other (908) 95 13 (9) (809)

RESTAURANT PROFIT $ 477 $ (31) $ (93) $ 9 $ 362

Restaurant margin 14.2% 12.1%

In 2012, the decrease in U.S. Company sales and Restaurant

profi t associated with store portfolio actions was primarily driven by

refranchising.Signifi cant other factors impacting Company sales and/

or Restaurant profi t were same-store sales growth of 5%, including the

positive impact of less discounting, combined with the positive impact

of sales mix shifts as well as supply chain effi ciencies, partially offset by

higher restaurant-level incentive compensation costs.

In 2011, the decrease in U.S. Company sales and Restaurant

profi t associated with store portfolio actions was primarily driven by

refranchising.Signifi cant other factors impacting Company sales and/or

Restaurant profi t were commodity infl ation of $55million, or 6%, Company

same-store sales declines of 3%, including a negative impact from sales

mix shift, and higher self-insurance costs.

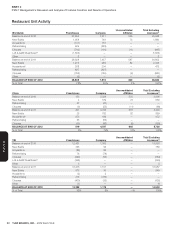

Franchise and L icense F ees and I ncome

Amount % Increase (Decrease)

% Increase (Decrease)

excluding foreign

currency translation

% Increase (Decrease)

excluding foreign

currency translation

and 53rd week

2012 2011 2010 2012 2011 2012 2011 2012 2011

China $ 101 $ 79 $ 54 29 45 25 38 25 38

YRI 879 851 729 3 17 7 12 8 11

U.S. 802 786 765 2 3 N/A N/A 4 1

India 18 17 12 6 39 18 39 18 39

WORLDWIDE $ 1,800 $ 1,733 $ 1,560 4116877

China Franchise and license fees and income increased 25% and 38%

in 2012 and 2011, respectively, excluding the impact of foreign currency

translation. The increases were driven by refranchising, new unit development

and positive franchise same-store sales.

YRI Franchise and license fees and income increased 8% in 2012, excluding

the impacts of foreign currency translation and the 53rd week in 2011.

The increase was driven by new unit development and positive franchise

same-store sales. YRI Franchise and license fees and income increased

11% in 2011, excluding the impacts of foreign currency translation and the

53

rd

week. The increase was driven by new unit development, refranchising

and positive franchise same-store sales.

U.S. Franchise and license fees and income increased 4% in 2012, excluding

the 53

rd

week in 2011. The increase was driven by refranchising, positive

franchise same-store sales and new unit development, partially offset by the

LJS and A&W divestitures and franchise store closures. U.S. Franchise and

license fees and income increased 1% in 2011, excluding the 53

rd

week. The

increase was driven by refranchising and new unit development, partially

offset by franchise store closures and franchise same-store sales declines.

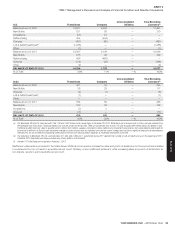

General and Administrative Expenses

Amount % Increase (Decrease)

% Increase (Decrease)

excluding foreign

currency translation

% Increase (Decrease)

excluding foreign

currency translation

and 53rd week

2012 2011 2010 2012 2011 2012 2011 2012 2011

China $ 334 $ 275 $ 216 21 27 19 22 19 22

YRI 414 400 361 3 11 6 7 7 6

U.S. 467 450 492 4 (8) N/A N/A 5 (9)

India 24 22 17 9 28 25 29 25 29

Unallocated 271 225 191 21 18 N/A N/A 22 17

WORLDWIDE $ 1,510 $ 1,372 $ 1,277 10 7 11 5 11 5

The increase in China G&A expenses for 2012, was driven by increased

compensation costs due to higher headcount and wage infl ation and

additional G&A as a result of consolidating Little Sheep.

The increase in China G&A expenses for 2011 was driven by increased

compensation costs due to wage infl ation and higher headcount.

The increase in YRI G&A expenses for 2012 was driven by increased

investment in strategic growth markets, including the acquisition of

restaurants in South Africa in 2011, and increased compensation costs

in the remaining markets.