Pizza Hut 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 20

Form 10-K

PART II

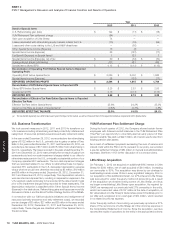

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

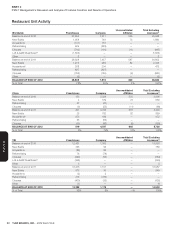

See the System Sales Growth section within our MD&A for further discussion on the impact of 53rd week in 2011 on system sales. The following table summarizes

the estimated impact of the 53rd week in 2011 on revenues and operating profi t:

U.S. YRI Unallocated Total

Revenues

Company sales $ 43 $ 29 $ — $ 72

Franchise and license fees 13 6 — 19

Total Revenues $56 $35 $ — $91

Operating profi t

Franchise and license fees $ 13 $ 6 $ — $ 19

Restaurant profi t 9 6 — 15

General and administrative expenses (4) (4) (1) (9)

OPERATING PROFIT(a) $ 18$ 8$ (1)$ 25

(a) The $25million benefit was offset throughout 2011 by investments, including franchise development incentives, as well as higher-than-normal spending, such as restaurant closures in the

U.S. and YRI.

YRI Acquisitions

In 2011, YRI acquired 68 KFC restaurants from an existing franchisee in

South Africa for $71million.

In 2010, we completed the exercise of our option with our Russian partner

to purchase their interest in the co-branded Rostik’s-KFC restaurants

across Russia and the Commonwealth of Independent States.As a result,

we acquired company ownership of 50 restaurants and gained full rights

and responsibilities as franchisor of 81 restaurants, which our partner

previously managed as master franchisee.We paid cash of $60million,

net of settlement of a long-term note receivable of $11million, and

assumed long-term debt of $10million which was subsequently repaid.

Of the remaining balance of the purchase price of $12million, a payment

of $9million was made in July2012 and the remainder is expected to be

paid in cash during 2013.

The impact of consolidating these businesses on all line-items within our

Consolidated Statement of Income was insignifi cant to the comparison

of our year-over-year results and is not expected to materially impact our

results going forward.

Store Portfolio Strategy

From time to time we sell Company restaurants to existing and new

franchisees where geographic synergies can be obtained or where

franchisees’ expertise can generally be leveraged to improve our overall

operating performance, while retaining Company ownership of strategic

U.S. and international markets in which we choose to continue investing

capital.In the U.S., we are targeting Company ownership of KFC, Pizza

Hut and Taco Bell restaurants of about 10%, down from its current level of

11%, with our primary remaining focus being refranchising at Taco Bell to

about 16% Company ownership from its current level of 20%.Consistent

with this strategy, 468, 404 and 404 Company restaurants in the U.S. were

sold to franchisees in the years ended December29, 2012, December31,

2011 and December25, 2010, respectively. Additionally, in December2012

we refranchised 331 remaining Company-owned dine-in restaurants in the

Pizza Hut UK business and during 2010, we refranchised all Company-

owned KFCs and Pizza Huts in Mexico (345 restaurants) and KFCs in

Taiwan (124 restaurants).

The following table summarizes our worldwide refranchising activities:

2012 2011 2010

Number of units refranchised 897 529 949

Refranchising proceeds, pre-

tax $ 364 $ 246 $ 265

Refranchising (gain) loss,

pre-tax $ (78) $ 72 $ 63

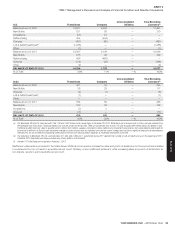

Refranchisings reduce our reported revenues and restaurant profi ts and

increase the importance of system sales growth as a key performance

measure.Additionally, G&A expenses will decline and franchise and

license expense can increase over time as a result of these refranchising

activities.The timing of G&A declines will vary and often lag the actual

refranchising activities as the synergies are typically dependent upon the

size and geography of the respective deals.G&A expenses included in the

tables below refl ect only direct G&A that we no longer incurred as a result

of stores that were operated by us for all or a portion of the respective

previous year and were no longer operated by us as of the last day of the

respective current year.

The impact on Operating Profi t arising from refranchising is the net of (a)

the estimated reductions in restaurant profi t and G&A expenses and (b)

the increase in franchise fees and expenses from the restaurants that

have been refranchised.The tables presented below refl ect the impacts

on Total revenues and on Operating Profi t from stores that were operated

by us for all or some portion of the respective previous year and were no

longer operated by us as of the last day of the respective current year.In

these tables, Decreased Company sales and Decreased Restaurant profi t

represents the amount of Company sales or restaurant profi t earned by

the refranchised restaurants during the period we owned them in the

prior year but did not own them in the current year.Increased Franchise

and license fees and income represents the franchise and license fees

and rent income from the refranchised restaurants that were recorded by

the Company in the current year during periods in which the restaurants

were Company stores in the prior year. Increased Franchise and license

expenses represent primarily rent and depreciation where we continue

to own or lease the underlying property for the refranchised restaurants

that were recorded by the Company in the current year during periods in

which the restaurants were Company stores in the prior year.