Pep Boys 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

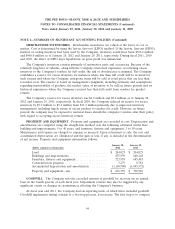

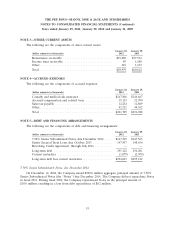

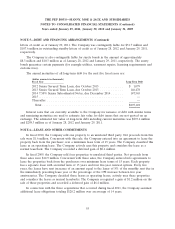

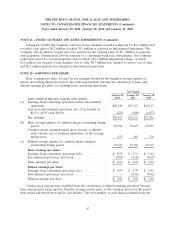

NOTE 3—OTHER CURRENT ASSETS

The following are the components of other current assets:

January 28, January 29,

(dollar amounts in thousands) 2012 2011

Reinsurance receivable ............................ $59,280 $57,532

Income taxes receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . 89 1,608

Other......................................... 610 1,672

Total ......................................... $59,979 $60,812

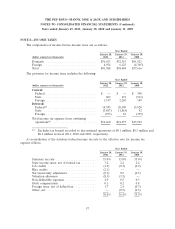

NOTE 4—ACCRUED EXPENSES

The following are the components of accrued expenses:

January 28, January 29,

(dollar amounts in thousands) 2012 2011

Casualty and medical risk insurance ................... $147,806 $146,667

Accrued compensation and related taxes ............... 19,133 31,990

Sales tax payable ................................ 12,254 12,809

Other ......................................... 42,512 44,562

Total ......................................... $221,705 $236,028

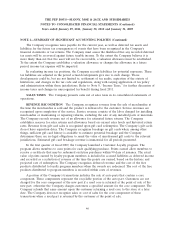

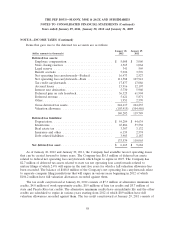

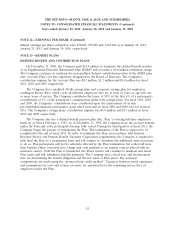

NOTE 5—DEBT AND FINANCING ARRANGEMENTS

The following are the components of debt and financing arrangements:

January 28, January 29,

(dollar amounts in thousands) 2012 2011

7.50% Senior Subordinated Notes, due December 2014 ..... $147,565 $147,565

Senior Secured Term Loan, due October 2013 ........... 147,557 148,636

Revolving Credit Agreement, through July 2016 .......... — —

Long-term debt ................................. 295,122 296,201

Current maturities ............................... (1,079) (1,079)

Long-term debt less current maturities ................. $294,043 $295,122

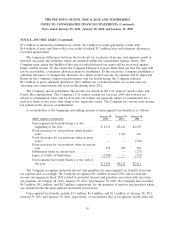

7.50% Senior Subordinated Notes, due December 2014

On December 14, 2004, the Company issued $200.0 million aggregate principal amount of 7.50%

Senior Subordinated Notes (the ‘‘Notes’’) due December 2014. The Company did not repurchase Notes

in fiscal 2011. During fiscal 2010, the Company repurchased Notes in the principal amount of

$10.0 million, resulting in a loss from debt repurchases of $0.2 million.

53