Pep Boys 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

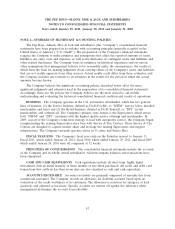

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

the fair value of a reporting unit with its carrying amount. If the carrying amount of a reporting unit

exceeds its fair value, the second step of the impairment test must be performed in order to determine

the amount of impairment loss, if any. The second step compares the implied fair value of reporting

unit goodwill with the carrying amount of that goodwill. If the carrying amount of reporting unit

goodwill exceeds the implied fair value of that goodwill, an impairment loss is recognized in an amount

equal to the excess. The loss recognized cannot exceed the carrying amount of goodwill. The implied

fair value of goodwill is determined in the same manner that the amount of goodwill recognized in a

business combination is determined. The Company allocates the fair value of a reporting unit to all of

the assets and liabilities of that unit, including intangible assets, as if the reporting unit had been

acquired in a business combination. Any excess of the value of a reporting unit over the amounts

assigned to its assets and liabilities is the implied fair value of goodwill.

There were no impairments as a result of the Company’s annual impairment tests in the fourth

quarter of fiscal year 2011 or fiscal year 2010.

LEASES The Company amortizes leasehold improvements over the lesser of the lease term or

the economic life of those assets. Generally, for stores the lease term is the base lease term and for

distribution centers the lease term includes the base lease term plus certain renewal option periods for

which renewal is reasonably assured and for which failure to exercise the renewal option would result

in an economic penalty to the Company. The calculation of straight-line rent expense is based on the

same lease term with consideration for step rent provisions, escalation clauses, rent holidays and other

lease concessions. The Company begins expensing rent at the time the Company has the right to use

the property.

SOFTWARE CAPITALIZATION The Company capitalizes certain direct development costs

associated with internal-use software, including external direct costs of material and services, and

payroll costs for employees devoting time to the software projects. These costs are amortized over a

period not to exceed five years beginning when the asset is substantially ready for use. Costs incurred

during the preliminary project stage, as well as maintenance and training costs are expensed as

incurred.

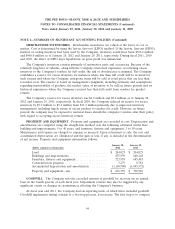

TRADE PAYABLE PROGRAM LIABILITY The Company has a trade payable program which is

funded by various bank participants who have the ability, but not the obligation, to purchase account

receivables owed by the Company directly from its vendors. The Company, in turn, makes the regularly

scheduled full vendor payments to the bank participants. In the first quarter of fiscal 2011 as a result of

the Company’s review, the Company determined that the gross amount of borrowings and payments on

the trade payable program shown on the statement of cash flows under ‘‘Cash flows from financing

activities’’ included certain vendors that had not participated in the trade payable program. As such,

the Company made an equal and offsetting adjustment to reduce the trade payables borrowings and

payments line items within financing activities by $225.2 million and $90.3 million for the years ended

January 29, 2011 and January 30, 2010, respectively. These adjustments have no net impact on net cash

used in financing activities or on any other cash flow line items.

INCOME TAXES The Company uses the asset and liability method of accounting for income

taxes. Deferred income taxes are determined based upon enacted tax laws and rates applied to the

differences between the financial statement and tax bases of assets and liabilities.

45