Pep Boys 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

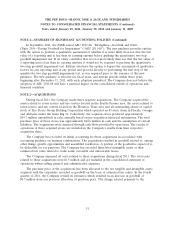

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Pep Boys—Manny, Moe & Jack and subsidiaries (the ‘‘Company’’) consolidated financial

statements have been prepared in accordance with accounting principles generally accepted in the

United States of America (‘‘U.S. GAAP’’). The preparation of the Company’s financial statements

requires the Company to make estimates and assumptions that affect the reported amounts of assets,

liabilities, net sales, costs and expenses, as well as the disclosure of contingent assets and liabilities and

other related disclosures. The Company bases its estimates on historical experience and on various

other assumptions that management believes to be reasonable under the circumstances, the results of

which form the basis for making judgments about carrying values of the Company’s assets and liabilities

that are not readily apparent from other sources. Actual results could differ from those estimates, and

the Company includes any revisions to its estimates in the results for the period in which the actual

amounts become known.

The Company believes the significant accounting policies described below affect the more

significant judgments and estimates used in the preparation of its consolidated financial statements.

Accordingly, these are the policies the Company believes are the most critical to aid in fully

understanding and evaluating the historical consolidated financial condition and results of operations.

BUSINESS The Company operates in the U.S. automotive aftermarket, which has two general

lines of business: (1) the Service business, defined as Do-It-For-Me, or ‘‘DIFM’’ (service labor, installed

merchandise and tires) and (2) the Retail business, defined as Do-It-Yourself, or ‘‘DIY’’ (retail

merchandise) and commercial. The Company’s primary store format is the Supercenter, which serves

both ‘‘DIFM’’ and ‘‘DIY’’ customers with the highest quality service offerings and merchandise. In

2009, as part of the Company’s long-term strategy to lead with automotive service, the Company began

complementing the existing Supercenter store base with Service & Tire Centers. These Service & Tire

Centers are designed to capture market share and leverage the existing Supercenter and support

infrastructure. The Company currently operates stores in 35 states and Puerto Rico.

FISCAL YEAR END The Company’s fiscal year ends on the Saturday nearest to January 31.

Fiscal 2011, which ended January 28, 2012, fiscal 2010, which ended January 29, 2011, and fiscal 2009

which ended January 30, 2010 were all comprised of 52 weeks.

PRINCIPLES OF CONSOLIDATION The consolidated financial statements include the accounts

of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have

been eliminated.

CASH AND CASH EQUIVALENTS Cash equivalents include all short-term, highly liquid

investments with an initial maturity of three months or less when purchased. All credit and debit card

transactions that settle in less than seven days are also classified as cash and cash equivalents.

ACCOUNTS RECEIVABLE Accounts receivable are primarily comprised of amounts due from

commercial customers. The Company records an allowance for doubtful accounts based upon an

evaluation of the credit worthiness of its customers. The allowance is reviewed for adequacy at least

quarterly, and adjusted as necessary. Specific accounts are written off against the allowance when

management determines the account is uncollectible.

43