Pep Boys 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

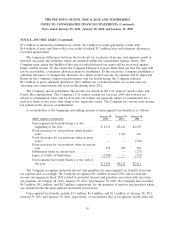

about purchases, sales, issuances or settlements in the roll forward activity for level 3 fair value

measurements which are effective for interim and annual periods beginning after December 15, 2010.

The adoption of ASU 2010-06 did not have a material impact on the Company’s consolidated financial

statements.

In December 2010, the FASB issued ASU 2010-29 ‘‘Business Combinations (Topic 805)—

Disclosure of Supplementary Pro Forma Information for Business Combinations’’ (ASU 2010-29). This

accounting standard update clarifies that SEC registrants presenting comparative financial statements

should disclose in their pro forma information revenue and earnings of the combined entity as though

the current period business combinations had occurred as of the beginning of the comparable prior

annual reporting period only. The update also expands the supplemental pro forma disclosures to

include a description of the nature and amount of material, nonrecurring pro forma adjustments

directly attributable to the business combination included in the reported pro forma revenue and

earnings. ASU 2010-29 is effective prospectively for material (either on an individual or aggregate

basis) business combinations entered into in fiscal years beginning on or after December 15, 2010 with

early adoption permitted. The adoption of ASU 2010-29 did not have a material impact on the

consolidated financial statements.

In May 2011, the FASB issued ASU 2011-04, ‘‘Fair Value Measurement (Topic 820)—Amendments

to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs’’

(‘‘ASU 2011-04’’), which is effective for annual reporting periods beginning after December 15, 2011.

This guidance amends certain accounting and disclosure requirements related to fair value

measurements. The Company does not believe the adoption of ASU 2011-04 will have a material

impact on the consolidated results of operations and financial condition.

In June of 2011, the FASB issued ASU No. 2011-05, ‘‘Presentation of Comprehensive Income’’

(‘‘ASU 2011-05’’). ASU 2011-05 was issued to improve the comparability of financial reporting between

U.S. GAAP and International Financial Reporting Standards, and eliminates previous U.S. GAAP

guidance that allowed an entity to present components of other comprehensive income (‘‘OCI’’) as part

of its statement of changes in shareholders’ equity. With the issuance of ASU 2011-05, companies are

now required to report all components of OCI either in a single continuous statement of total

comprehensive income, which includes components of both OCI and net income, or in a separate

statement appearing consecutively with the statement of income. ASU 2011-05 does not affect current

guidance for the accounting of the components of OCI, or which items are included within total

comprehensive income, and is effective for periods beginning after December 15, 2011, with early

adoption permitted. On December 23, 2011, the FASB issued ASU 2011-12, which indefinitely defers

the provision in ASU 2011-05 that required entities to present reclassification adjustments out of

accumulated other comprehensive income by component in both the statements in which net income is

presented and the statement in which OCI is presented. The other provisions in ASU 2011-05 are

unaffected by the deferral. The application of this guidance affects presentation only and therefore is

not expected to have an impact on the Company’s consolidated financial condition, results of

operations or cash flows.

50