Pep Boys 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

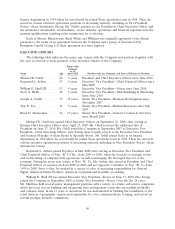

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

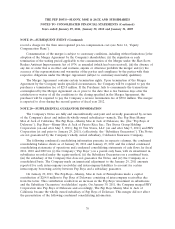

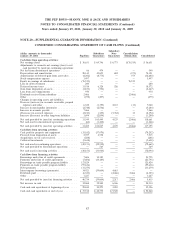

NOTE 20—SUPPLEMENTAL GUARANTOR INFORMATION (Continued)

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS (Continued)

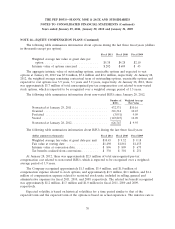

(dollar amounts in thousands) Subsidiary Subsidiary Consolidation/

Year ended January 29, 2011 Pep Boys Guarantors Non-Guarantors Elimination Consolidated

Merchandise sales ............. $550,017 $1,048,151 $ — $ — $1,598,168

Service revenue ............... 140,716 249,757 — — 390,473

Other revenue ................ — — 22,944 (22,944) —

Total revenues ................ 690,733 1,297,908 22,944 (22,944) 1,988,641

Costs of merchandise sales ....... 387,425 724,586 — (1,631) 1,110,380

Costs of service revenue ......... 124,675 231,387 — (153) 355,909

Costs of other revenue .......... — — 16,709 (16,709) —

Total costs of revenues .......... 512,100 955,973 16,709 (18,493) 1,466,289

Gross profit from merchandise sales 162,592 323,565 — 1,631 487,788

Gross profit from service revenue . . 16,041 18,370 — 153 34,564

Gross profit from other revenue . . . — — 6,235 (6,235) —

Total gross profit .............. 178,633 341,935 6,235 (4,451) 522,352

Selling, general and administrative

expenses ................... 158,699 290,111 346 (6,917) 442,239

Net gain from dispositions of assets . 1,873 594 — — 2,467

Operating profit ............... 21,807 52,418 5,889 2,466 82,580

Non-operating (expenses) income . . (16,271) 81,965 2,468 (65,553) 2,609

Interest expenses (income) ....... 65,422 26,497 (2,087) (63,087) 26,745

(Loss) earnings from continuing

operations before income taxes . . (59,886) 107,886 10,444 — 58,444

Income tax (benefit) expenses ..... (20,064) 37,666 3,671 — 21,273

Equity in earnings of subsidiaries . . 76,519 — — (76,519) —

Earnings (loss) from continuing

operations ................. 36,697 70,220 6,773 (76,519) 37,171

Loss from discontinued operations,

net of tax.................. (66) (474) — — (540)

Net earnings (loss) ............. $ 36,631 $ 69,746 $ 6,773 $(76,519) $ 36,631

80