Pep Boys 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

NOTE 19—SUBSEQUENT EVENT (Continued)

record a charge for the then unrecognized pre-tax compensation cost (see Note 14, ‘‘Equity

Compensation Plans’’).

Consummation of the merger is subject to customary conditions, including without limitation (i) the

adoption of the Merger Agreement by the Company’s shareholders, (ii) the expiration or early

termination of the waiting period applicable to the consummation of the Merger under the Hart-Scott-

Rodino Antitrust Improvements Act of 1974, as amended (which has been received), (iii) the absence of

any law or order that is in effect and restrains, enjoins or otherwise prohibits the merger and (iv) the

accuracy of the representations and warranties of the parties and compliance by the parties with their

respective obligations under the Merger Agreement (subject to customary materiality qualifiers).

The Merger Agreement contains certain termination rights. Upon termination of the Merger

Agreement by the Company under specified circumstances, the Company will be required to pay the

purchaser a termination fee of $25.0 million. If the Purchaser fails to consummate the transactions

contemplated by the Merger Agreement on or prior to the date that is five business days after the

satisfaction or waiver of all the conditions to the closing specified in the Merger Agreement, the

purchaser will be required to pay the Company a reverse termination fee of $50.0 million. The merger

is expected to close during the second quarter of fiscal year 2012.

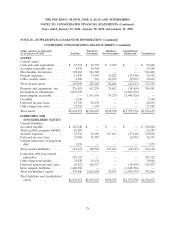

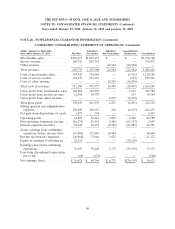

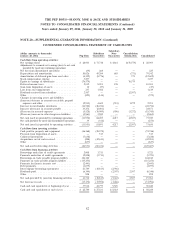

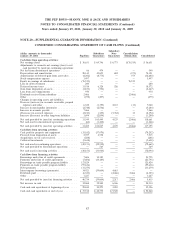

NOTE 20—SUPPLEMENTAL GUARANTOR INFORMATION

The Company’s Notes are fully and unconditionally and joint and severally guaranteed by certain

of the Company’s direct and indirectly wholly-owned subsidiaries—namely, The Pep Boys Manny

Moe & Jack of California, The Pep Boys—Manny Moe & Jack of Delaware, Inc. (the ‘‘Pep Boys of

Delaware’’); Pep Boys—Manny Moe & Jack of Puerto Rico, Inc.; Tire Stores Group Holding

Corporation (on and after May 5, 2011); Big 10 Tire Stores, LLC (on and after May 5, 2011) and PBY

Corporation (at and prior to January 29, 2011), (collectively, the ‘‘Subsidiary Guarantors’’). The Notes

are not guaranteed by the Company’s wholly owned subsidiary, Colchester Insurance Company.

The following condensed consolidating information presents, in separate columns, the condensed

consolidating balance sheets as of January 28, 2012 and January 29, 2011 and the related condensed

consolidating statements of operations and condensed consolidating statements of cash flows for fiscal

2011, 2010 and 2009 for (i) the Company (‘‘Pep Boys’’) on a parent only basis, with its investment in

subsidiaries recorded under the equity method, (ii) the Subsidiary Guarantors on a combined basis,

(iii) the subsidiary of the Company that does not guarantee the Notes, and (iv) the Company on a

consolidated basis. The Company made an immaterial adjustment to the January 29, 2011 amounts

reported for cash, intercompany receivables and intercompany liabilities to account for certain

intercompany borrowing activity between Pep Boys and a subsidiary guarantor.

On January 29, 2011, The Pep Boys—Manny, Moe & Jack of Pennsylvania made a capital

contribution of $264.0 million to Pep Boys of Delaware consisting of intercompany receivables due

from the latter. This contribution resulted in an increase in the Pep Boys’ investment in subsidiaries

and the Subsidiary Guarantors’ stockholders’ equity. On January 30, 2011, the Company merged PBY

Corporation into Pep Boys of Delaware and accordingly, The Pep Boys Manny Moe & Jack of

California became the wholly owned subsidiary of Pep Boys of Delaware. This merger did not affect

the presentation of the following condensed consolidating information.

76