Pep Boys 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and business model allow us to buy quality parts at lower prices and pass those savings onto our

customers. We believe that offering a broad assortment of private label and branded tires at

competitive prices provides a competitive advantage to the Company since many of our DIFM

competitors do not sell tires and related services. In order to become the leading tire retailer, we

developed key partnerships that expand our national branded tire offerings and launched a new

interactive web application called TreadSmart which gives customers the ability to research, purchase

and schedule tire installation online.

Our store growth plans are centered on a ‘‘hub and spoke’’ model, which calls for adding smaller

neighborhood Service & Tire Centers to our existing Supercenter store base in order to further

leverage our existing inventories, distribution network, operations infrastructure and advertising spend.

We acquired 99 Service & Tire Centers and opened 21 new stores in 2011—20 Service & Tire Centers

and one Supercenter. Our plans call for 75 new Service & Tire and 10 Supercenter locations in 2012.

The typical Service & Tire Center is full service with approximately six service bays and $1.0 million in

expected annual sales. Our Service & Tire Centers offer customer convenience, allowing us to be close

to our customers’ home or work and generally serve a higher income demographic customer than our

Supercenters. To further leverage our store investment, we are focused on expanding our vehicle fleet

business by communicating our value offering to local and national fleet accounts through targeted

marketing, improving store execution and expanding our dedicated fleet resources

Establish a differentiated Retail experience by leveraging our Automotive Superstore. The size of

our stores allows us to provide the highest level of replacement parts coverage and the broadest range

of maintenance, performance and appearance products and accessories in the industry. We are able to

leverage our Superhub stores, which have a larger assortment of product than our normal Supercenter,

to satisfy customer needs for slow-moving product by delivering this product to requesting Supercenters

on demand. As part of our commitment to carry the best assortment of automotive aftermarket

merchandise, we make assortment decisions by examining every merchandise category using market and

demographic data to assure we have the best product in the right place. This category management

process ensures our assortment includes the appropriate coverage for service, DIY and commercial

consumers as well as allowing us to make good, sound decisions about price, product and promotions.

Leverage our Automotive Superstore to provide the most complete offering for our Commercial

customers. To further leverage our inventory and automotive aftermarket expertise, we continue to

expand our commercial operations. In addition to offering these customers parts and fluids, we enjoy a

competitive advantage of also being able to offer tires, equipment, accessories and services.

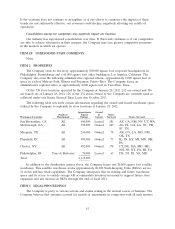

STORE IMPROVEMENTS

In fiscal 2011, the Company’s capital expenditures totaled $74.7 million which, in addition to our

regularly-scheduled facility improvements, included the addition of 21 stores and information

technology enhancements. Our fiscal 2012 capital expenditures are expected to be approximately $80.0

million, which includes the addition of approximately 75 Service & Tire Centers, 10 Supercenters and

the conversion of 15 Supercenters into Superhubs, which have a larger assortment of auto parts than

our normal Supercenter. These expenditures are expected to be funded from cash on hand and net

cash generated from operating activities. Additional capacity, if needed, exists under our revolving

credit facility.

SERVICES AND PRODUCTS

The Company operates a total of 7,182 service bays in 731 of its 738 locations. Each service

location performs a full range of automotive maintenance and repair services (except body work) and

installs tires, hard parts and accessories.

5