Pep Boys 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

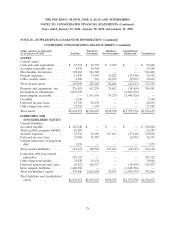

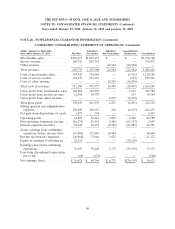

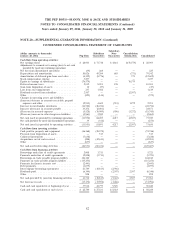

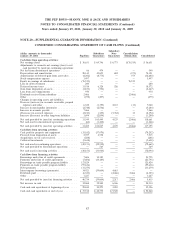

NOTE 20—SUPPLEMENTAL GUARANTOR INFORMATION (Continued)

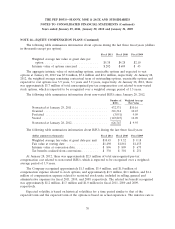

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

(dollar amounts in thousands) Subsidiary Subsidiary Consolidation/

Year ended January 28, 2012 Pep Boys Guarantors Non-Guarantors Elimination Consolidated

Merchandise sales ............. $546,420 $1,096,337 $ — $ — $1,642,757

Service revenue ............... 146,021 274,849 — — 420,870

Other revenue ................ — — 23,355 (23,355) —

Total revenues ................ 692,441 1,371,186 23,355 (23,355) 2,063,627

Costs of merchandise sales ....... 392,065 763,939 — (1,682) 1,154,322

Costs of service revenue ......... 132,635 267,302 — (161) 399,776

Costs of other revenue .......... — — 20,140 (20,140) —

Total costs of revenues .......... 524,700 1,031,241 20,140 (21,983) 1,554,098

Gross profit from merchandise sales 154,355 332,398 — 1,682 488,435

Gross profit from service revenue . . 13,386 7,547 — 161 21,094

Gross profit from other revenue . . . — — 3,215 (3,215) —

Total gross profit .............. 167,741 339,945 3,215 (1,372) 509,529

Selling, general and administrative

expenses ................... 156,184 291,372 329 (3,899) 443,986

Net gain from dispositions of assets . (10) 37 — — 27

Operating profit ............... 11,547 48,610 2,886 2,527 65,570

Non-operating (expenses) income . . (16,492) 64,157 2,528 (47,869) 2,324

Interest expenses (income) ....... 70,685 3,050 (2,087) (45,342) 26,306

(Loss) earnings from continuing

operations before income taxes . . (75,630) 109,717 7,501 — 41,588

Income tax (benefit) expense ..... (27,915) 37,715 2,660 — 12,460

Equity in earnings of subsidiaries . . 76,579 — — (76,579) —

Earnings (loss) from continuing

operations ................. 28,864 72,002 4,841 (76,579) 29,128

Loss from discontinued operations,

net of tax.................. 39 (264) — — (225)

Net earnings (loss) ............. $ 28,903 $ 71,738 $ 4,841 $(76,579) $ 28,903

79