Pep Boys 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.locations in operation during the same period of the prior year) decreased by 0.6%. This decrease in

comparable store sales was comprised of a 0.6% increase in comparable store service revenue offset by

a 0.9% decrease in comparable store merchandise sales.

Sales of our services and non-discretionary products are impacted by miles driven. From March

through December 2011, unleaded gasoline prices averaged $3.59 per gallon (national average) as

compared to $2.80 in the corresponding period of the prior year. We believe the significant increase in

gasoline prices led to the 1.8% decrease in miles driven from March through November 2011, after

growing moderately over the previous 12 months. This change in trend combined with the financial

burden of higher gasoline prices, continued high unemployment and negative consumer confidence in

the overall U.S. economy depressed our fiscal 2011 sales. We believe these factors have also led

customers to maintain their existing vehicles, rather than purchasing new ones which, in turn has

partially offset the negative impact the reduction in miles driven has had on our sales of services and

non-discretionary products. These same factors have negatively affected sales in our discretionary

product categories like accessories and complementary merchandise. Given the nature of these

macroeconomic factors, we cannot predict whether or for how long these trends will continue, nor can

we predict to what degree these trends will affect us in the future. In addition, an unseasonably warm

winter quarter in fiscal 2011 reduced sales in certain categories including wiper blades, batteries,

antifreeze and winter goods.

Our primary response to fluctuations in customer demand is to adjust our service and product

assortment, store staffing and advertising messages. We believe that we are well positioned to help our

customers save money and meet their needs in a challenging macroeconomic environment. In 2011, we

have continued our ‘‘surround sound’’ media campaign that utilizes television, radio, digital and direct

mail advertising to communicate our ‘‘DOES EVERYTHING. FOR LESS.’’ brand message and have

focused on ‘‘execution excellence’’ in our stores in order to earn the TRUST of our customers every

day. We continue to develop innovative ways to make it more convenient for customers to do business

with us and in the third quarter of 2011 we launched TreadSmart, which gives customers the ability to

research, purchase and schedule the installation of tires online at a local Pep Boys location. We are

currently piloting, and expect to roll-out nationally in 2012, eCommerce solutions that will allow retail

customers to purchase products online for pick up at their local store or delivery to their home and

commercial customers to order, pay and manage their accounts online.

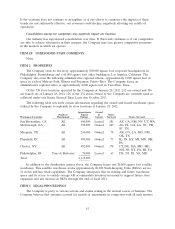

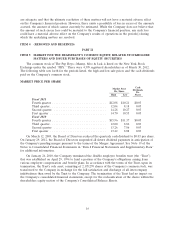

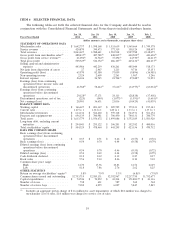

RESULTS OF OPERATIONS

The following discussion explains the material changes in our results of operations for the years

ended January 28, 2012 and January 29, 2011 and January 30, 2010.

22