Pep Boys 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

member of the Nominating and Governance Committee, the Chairman of the Board and the President & Chief

Executive Officer.

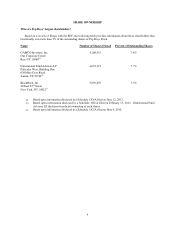

How are directors compensated?

Cash Retainer. Each non-management director (other than the Chairman of the Board) receives an annual cash

retainer of $35,000. Our Chairman of the Board receives an annual director’s fee of $100,000.

Committee Compensation. Directors serving on our committees also receive the following annual cash fees.

Chair Member

Audit $20,000 $12,000

Compensation $15,000 $ 7,500

Nominating and Governance $10,000 $ 5,000

Operating Efficiency (suspended June 6, 2011) $10,000 $ 5,000

Equity Grants. Our 2009 Stock Incentive Plan provides for an annual equity grant having an aggregate value of

$55,000 to non-management directors. The Stock Incentive Plan is administered, interpreted and implemented by

the Compensation Committee.

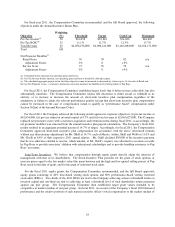

The following table details the compensation paid to non-employee directors during the fiscal year ended January

28, 2012.

Director Compensation Table

Name

Fees Earned or

Paid in Cash

($)

Equity Awards

($)

Total

($)

M. Shân Atkins 55,000 55,000 110,000

Robert H. Hotz 62,125 55,000 117,125

James A. Mitarotonda 47,500 55,000 102,500

Irvin D. Reid 49,500 55,000 104,500

Jane Scaccetti 60,000 55,000 115,000

John T. Sweetwood 50,000 55,000 105,000

Nick White 45,000 55,000 100,000

James A. Williams 52,000 55,000 107,000

Max L. Lukens(1) 75,000 55,000 130,000

(1) Mr. Lukens resigned from the Board and his position as Chairman of the Board for personal reasons

on September 10, 2011.

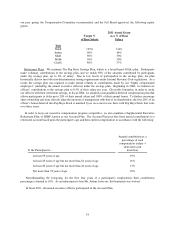

Share Ownership Guidelines. Each of our non-employee directors is expected to hold shares equal to 4x the

annual director retainer (i.e., $140,000). The share ownership levels may be satisfied through direct share ownership

and/or by holding unvested time-based RSUs and vested “in the money” stock options. Non-employee directors

have five years from their appointment to Board to achieve their expected ownership level. If in a shortfall position,

(i) a non-employee director may not sell Pep Boys Stock and (ii) all net after-tax shares acquired upon the exercise

of stock options must be retained. All of our non-employee directors are currently in compliance with our share

ownership guidelines.

Certain Relationships and Related Transactions

The Audit Committee, which is comprised of independent directors, has established a written Related Party

Transaction Policy. Such policy provides that to help identify related-party transactions and relationships (i) all