Pep Boys 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

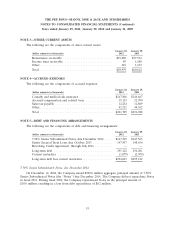

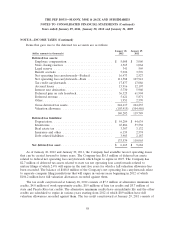

NOTE 11—STORE CLOSURES AND ASSET IMPAIRMENTS (Continued)

During fiscal 2009, the Company sold four stores classified as held for disposal for $3.6 million and

recorded a net gain of $0.2 million of which $0.1 million is reported in discontinued operations. The

Company also decided to reopen one store and moved the carrying value of $1.7 million to property

and equipment. During fiscal 2009 in response to a continuing weak real estate market, the Company

reduced its prices for certain properties and recorded a $3.1 million impairment charge, of which

$2.2 million was charged to merchandise cost of sales, $0.7 million was charged to service cost of sales

and $0.2 million (pretax) was charged to discontinued operations.

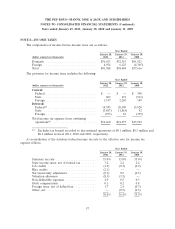

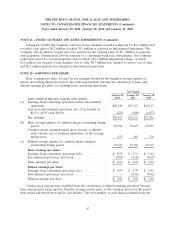

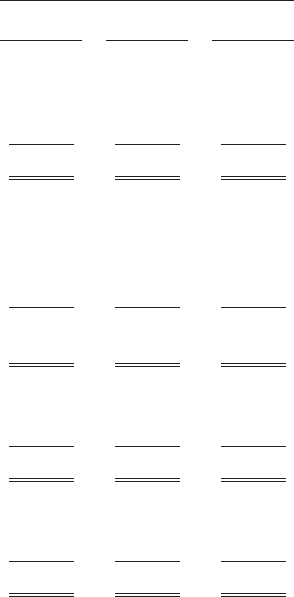

NOTE 12—EARNINGS PER SHARE

Basic earnings per share is based on net earnings divided by the weighted average number of

shares outstanding during the period. The following schedule presents the calculation of basic and

diluted earnings per share for earnings from continuing operations:

Year Ended

January 28, January 29, January 30,

2012 2011 2010

(dollar amounts in thousands, except per share amounts)

(a) Earnings from continuing operations before discontinued

operations .................................... $29,128 $37,171 $24,113

Loss from discontinued operations, net of tax benefit of

$(121), $(291) and $(580) ......................... (225) (540) (1,077)

Net earnings .................................... $28,903 $36,631 $23,036

(b) Basic average number of common shares outstanding during

period ....................................... 52,958 52,677 52,397

Common shares assumed issued upon exercise of dilutive

stock options, net of assumed repurchase, at the average

market price .................................. 673 485 270

(c) Diluted average number of common shares assumed

outstanding during period ......................... 53,631 53,162 52,667

Basic earnings per share:

Earnings from continuing operations (a/b) .............. $ 0.55 $ 0.71 $ 0.46

Discontinued operations, net of tax ................... (0.01) (0.01) (0.02)

Basic earnings per share ........................... $ 0.54 $ 0.70 $ 0.44

Diluted earnings per share:

Earnings from continuing operations (a/c) ............... $ 0.54 $ 0.70 $ 0.46

Discontinued operations, net of tax ................... — (0.01) (0.02)

Diluted earnings per share .......................... $ 0.54 $ 0.69 $ 0.44

Certain stock options were excluded from the calculations of diluted earnings per share because

their exercise prices were greater than the average market price of the common shares for the period

then ended and therefore would be anti-dilutive. The total number of such shares excluded from the

62