Pep Boys 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

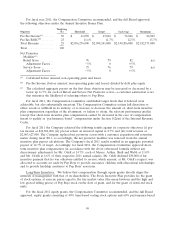

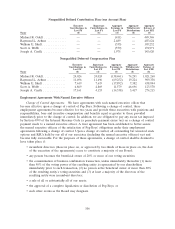

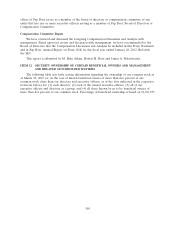

Nonqualified Defined Contribution Plan (our Account Plan)

Executive Registrant Aggregate Aggregate Aggregate

Contributions in Contributions in Earnings in Withdrawals/ Balance at

Last FY Last FY Last FY Distributions Last FYE

Name ($) ($) ($) ($) ($)

Michael R. Odell ............. — — (411) — 449,346

Raymond L. Arthur ........... — — 2,489 — 407,624

William E. Shull .............. — — (335) — 103,232

Scott A. Webb ............... — — (579) — 174,971

Joseph A. Cirelli ............. — — 1,975 — 143,620

Nonqualified Deferred Compensation Plan

Executive Registrant Aggregate Aggregate Aggregate

Contributions in Contributions in Earnings in Withdrawals/ Balance at

Last FY Last FY Last FY Distributions Last FYE

Name ($) ($) ($) ($) ($)

Michael R. Odell ............. 24,024 24,024 (138,461) 74,291 1,021,260

Raymond L. Arthur ........... 11,496 11,496 (69,252) 19,224 909,338

William E. Shull ............. 7,619 7,619 (17,892) 7,382 438,894

Scott A. Webb ............... 4,869 4,869 11,579 46,696 123,570

Joseph A. Cirelli ............. 17,161 4,153 (14,338) 5,417 274,215

Employment Agreements With Named Executive Officers

Change of Control Agreements. We have agreements with each named executive officer that

become effective upon a change of control of Pep Boys. Following a change of control, these

employment agreements become effective for two years and provide these executives with positions and

responsibilities, base and incentive compensation and benefits equal or greater to those provided

immediately prior to the change of control. In addition, we are obligated to pay any excise tax imposed

by Section 4999 of the Internal Revenue Code (a parachute payment excise tax) on a change of control

payment made to a named executive officer. A trust agreement has been established to better assure

the named executive officers of the satisfaction of Pep Boys’ obligations under their employment

agreements following a change of control. Upon a change of control, all outstanding but unvested stock

options and RSUs held by our all of our associates (including the named executive officers) vest and

become fully exercisable. For the purposes of these agreements, a change of control shall be deemed to

have taken place if:

• incumbent directors (those in place on, or approved by two-thirds of those in place on, the date

of the execution of the agreements) cease to constitute a majority of our Board;

• any person becomes the beneficial owner of 20% or more of our voting securities;

• the consummation of business combination transaction, unless immediately thereafter (1) more

than 50% of the voting power of the resulting entity is represented by our shareholders

immediately prior to such transaction, (2) no person is the beneficial owner of more than 20%

of the resulting entity’s voting securities and (3) at least a majority of the directors of the

resulting entity were incumbent directors;

• a sale of all or substantially all of our assets;

• the approval of a complete liquidation or dissolution of Pep Boys; or

• such other events as the Board may designate.

106