Pep Boys 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

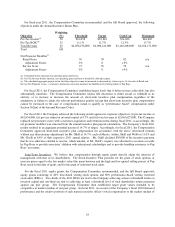

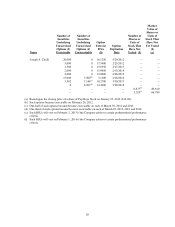

For fiscal year 2011, the Compensation Committee recommended, and the full Board approved, the following

objectives under the Annual Incentive Bonus Plan.

Objective

Weighting

(%) Threshold Target Cash Cap Maximum

Pre-Tax Income(a) 50 $61,058 $67,842 $74,826 $84,803

Pre-Tax ROIC(b) 25 11.1% 11.7% 12.5% 13.7%

Total Revenue25 $2,056,276,000 $2,098,241,000 $2,140,206,000 $2,182,171,000

Total 100

Net Promotor Modifier(c) :

Retail Score 76 79 82 n/a

Adjustment Factor -5% 0+5%

Service Score 73 76 79 n/a

Adjustment Factor -5% 0+5%

(a) Calculated before unusual, non-operating gains and losses.

(b) Pre-Tax Income (before unusual, non-operating gains and losses) divided by debt plus equity.

(c) The calculated aggregate payout on the first three objectives may be increased or decreased by a factor up to 5% for each of Retail and

Service Net Promoter scores - a customer satisfaction score that measures the likelihood of referring others to Pep Boys.

For fiscal 2011, the Compensation Committee established target levels that it believed were achievable, but also

substantially uncertain. The Compensation Committee retains full discretion to either award or withhold in its

entirety, or to increase or decrease the amount of, short-term incentive plan compensation regardless of the

attainment,or failure to attain, the relevant performance goal(s) (except that short-term incentive plan compensation

cannot be increased in the case of compensation meant to qualify as “performance based” compensation under

Section 162(m) of the Internal Revenue Code).

For fiscal 2011 the Company achieved the following results against its corporate objectives (i) pre-tax income at

$42,834,000, (ii) pre-tax return on invested capital at 8.7% and (iii) total revenue at $2,063,627,000. The Company

replaced net promoter scores with a customer acquisition and retention metric during fiscal 2011, so accordingly, the

net promoter modifier was removed from the annual incentive plan payout calculations. The Company’s fiscal 2011

results resulted in an aggregate potential payout of 14.7% of target. Accordingly, for fiscal 2011, the Compensation

Committee approved short-term incentive plan compensation (in accordance with the above referenced formula

without any discretionary adjustment) for Mr. Odell at 14.7%, each of Messrs. Arthur, Shull and Webb at 11.0% and

Mr. Cirelli at 6.6% of their respective 2011 annual salaries. Mr. Odell declined $30,000 of his incentive payment

that he was otherwise entitled to receive, which amount, at Mr. Odell’s request, was allocated to accounts set aside

by Pep Boys to provide associates’ children with educational scholarships and to provide hardship assistance to Pep

Boys’ associates.

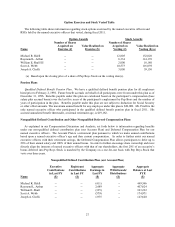

Long-Term Incentives. We believe that compensation through equity grants directly aligns the interests of

management with that of its shareholders. The Stock Incentive Plan provides for the grant of stock options, at

exercise prices equal to the fair market value (the mean between and the high and low quoted selling prices) of Pep

Boys stock on the date of grant,and for the grant of restricted stock units.

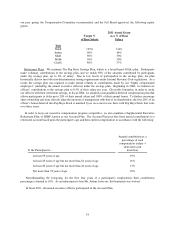

For the fiscal 2011 equity grants, the Compensation Committee recommended, and the full Board approved,

equity grants consisting of 40% time-based vesting stock options and 60% performance-based vesting restricted

stock units (RSUs). Two-thirds of the 2011 RSUs are tied to the Company achieving at least a threshold return on

invested capital and one-third are tied to achieving at least a threshold level of total shareholder return measured

against our peer group. The Compensation Committee then established target grant values intended to be

competitive at market median of our peer group. In fiscal 2011, on account of the Company’s fiscal 2010 financial

performance and the relative position of each named executive officer’s total compensation to the market median of