Pep Boys 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share Ownership Guidelines. Each of our non-employee directors is expected to hold shares equal

to 4x the annual cash retainer (i.e. $140,000). The share ownership levels may be satisfied through

direct share ownership and/or by holding unvested time-based RSUs and vested ‘‘in the money’’ stock

options. Non-employee directors have five years from their appointment to the Board to achieve their

expected ownership level. If in a shortfall position, (i) a non-employee director may not sell Pep Boys

Stock and (ii) all net after-tax shares acquired upon the exercise of stock options must be retained. All

of our non-employee directors are currently in compliance with our share ownership guidelines.

NAMED EXECUTIVE OFFICERS

Compensation Discussion and Analysis

In this section, we discuss and analyze Pep Boys’ executive compensation program, which we

believe links pay to financial results and allows us to attract and retain a highly experienced and

successful management team.

The Company provides its shareholders with the opportunity to cast an annual advisory vote on

executive compensation (a ‘‘say-on-pay proposal’’). At the Company’s annual meeting of shareholders

held in June 2011, 97% of the votes cast on the say-on-pay proposal at that meeting were voted in

favor of the Company’s executive compensation for 2010. The Compensation Committee believes this

affirms shareholders’ support of the Company’s approach to executive compensation. In light of the

voting results, the Committee did not materially change its approach in 2011. The Compensation

Committee will continue to consider the outcome of advisory votes on the Company’s say-on-pay

proposals when making future compensation decisions for the named executive officers.

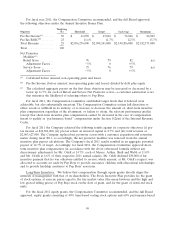

Pay for Performance. Our financial performance in fiscal 2011 was disappointing. While we grew

our top line revenues, due largely to our opening of 119 Service & Tire Centers, we failed to improve

our profitability over the levels achieved in fiscal 2010. These disappointing results were reflected in

our executive officers’ compensation, which is heavily weighted towards performance. Because we failed

to achieve the majority of the targets set forth under our annual incentive bonus plan, our executive

officers fiscal 2011 bonuses were paid at only 14.7% of target. In addition, no named executive officer

received Company contributions to their retirement plans (neither the Account Plan nor Savings Plan).

As a result our named executive officers total compensation in fiscal 2011 was, on average, 40% less

than in fiscal 2010. Also, 60% of the long-term incentive awards made under our Stock Incentive Plan

in fiscal 2011 require the Company to achieve specified thresholds of return on invested capital and

total shareholder return in fiscal 2014 in order to deliver any value to our executives. The 40% balance

of the long-term incentive awards granted in fiscal 2011 were in the form of stock options, which are

also performance-based since they require appreciation in the Company’s per share stock price in order

to deliver value to our executives.

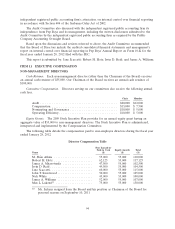

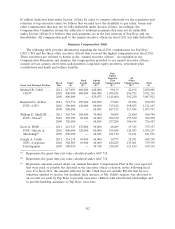

Of the components comprising our executive compensation program, the percentage mix between

‘‘at-risk’’ and fixed compensation (excluding health and welfare benefits), at target levels, for each of

our named executive officers is set forth in the following table. ‘‘At-risk’’ compensation is only earned

and paid if pre-established performance levels are achieved.

Name ‘‘At-Risk’’ Fixed

Michael R. Odell ..................................... 73% 27%

Raymond L. Arthur ................................... 63% 37%

William E. Shull III ................................... 61% 39%

Scott A. Webb ....................................... 63% 37%

Joseph A. Cirelli ..................................... 46% 54%

95