Pep Boys 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

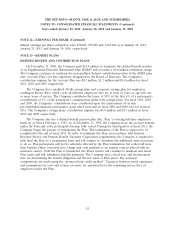

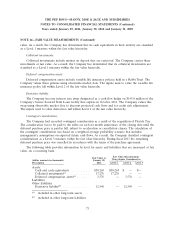

NOTE 13—BENEFIT PLANS (Continued)

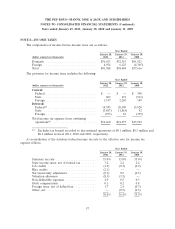

Benefit payments, including amounts to be paid from Company assets, as appropriate, are expected

to be paid as follows:

(dollar amounts in thousands)

2013 .................................................... $ 1,987

2014 .................................................... 2,094

2015 .................................................... 2,204

2016 .................................................... 2,326

2017 .................................................... 2,450

2018 - 2022 ............................................... 14,464

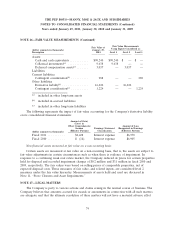

Plan Assets and Investment Policy

Investment policies are established in accordance with the Company’s Benefits Committee (the

‘‘Committee’’) responsibilities to the participants of the Plan and its beneficiaries, and in accordance

with the Employee Retirement Income Security Act of 1974, as amended (‘‘ERISA’’). The objective of

the Plan is to meet current and future benefit payment needs within the constraints of diversification

and prudent risk taking. The Plan is diversified across asset classes to achieve an optimal balance

between risk and return and between income and growth of assets through capital appreciation.

Investment objectives for each asset class are determined based on specific risks and investment

opportunities identified. The Company believes that the diversification of its assets minimizes the risk

due to concentration of the Plan assets.

The Company updates its long-term, strategic asset allocations annually using various analytics to

determine the optimal asset mix and consideration of plan liability characteristics, liquidity

characteristics, funding requirements, expected rates of return and the distribution of returns. Actual

allocations to each asset class vary from target allocations due to periodic investment strategy changes,

market value fluctuations, the length of time it takes to fully implement investment allocation positions

(such as private equity and real estate), and the timing of benefit payments and contributions. Short

term investments and exchange-traded derivatives are used to rebalance the actual asset allocation to

the target asset allocation. The asset allocation is monitored and rebalanced on a monthly basis.

The manager of the investments provides advice and recommendations to help the Committee

discharge its fiduciary responsibilities in furtherance of the Plan’s goals and objectives. The manager

has the discretion to allocate assets among funds within each asset class to conform to strategic targets

and ranges established by the Committee. The target asset allocation is 50% equity securities and 50%

fixed income. The investment policy requires that the asset allocation be maintained within certain

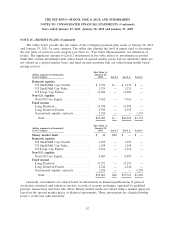

ranges. The weighted average asset allocations and asset allocation ranges by asset category are as

follows:

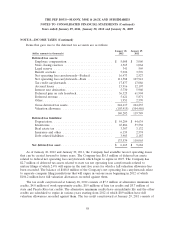

Weighted Average Asset Allocations

January 28, January 29, Asset Allocation

2012 2011 Ranges

Total equities . . . . . . . . . . . . . . . . . . . . . . . . 50% 52% 45 - 55%

Domestic equities . . . . . . . . . . . . . . . . . . . 32% 31% 28 - 38%

Non-US equities . . . . . . . . . . . . . . . . . . . . 18% 21% 12 - 22%

Fixed income . . . . . . . . . . . . . . . . . . . . . . . . 50% 48% 45 - 55%

66