Pep Boys 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172

|

|

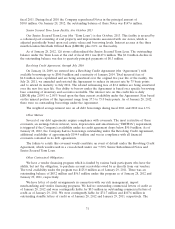

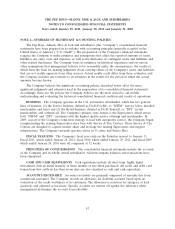

outstanding borrowings under the agreement. Additionally, the Company has a Senior Secured Term

Loan facility with a balance of $147.6 million at January 28, 2012, that bears interest at three month

LIBOR plus 2.00%. Excluding our interest rate swap, a one percent change in the LIBOR rate would

have affected net earnings by approximately $1.0 million for fiscal 2011. The risk related to changes in

the three month LIBOR rate are substantially mitigated by our interest rate swap.

The fair value of the Company’s fixed rate debt instruments, principally the 7.50% Senior

Subordinated Notes due December 15, 2014, was $149.0 million and $147.6 million at January 28, 2012

and January 29, 2011, respectively. The Company determines fair value on its fixed rate debt by using

quoted market prices and current interest rates.

Interest Rate Swaps

The Company entered into an interest rate swap for a notional amount of $145.0 million that is

designated as a cash flow hedge on the first $145.0 million of the Company’s Senior Secured Term

Loan facility. The interest rate swap converts the variable LIBOR portion of the interest payments to a

fixed rate of 5.036% and terminates in October 2013. As of January 28, 2012 and January 29, 2011, the

fair value of the swap was a net $12.5 million and $16.4 million payable, respectively, recorded within

other long-term liabilities on the balance sheet.

37