Pep Boys 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

NOTE 13—BENEFIT PLANS (Continued)

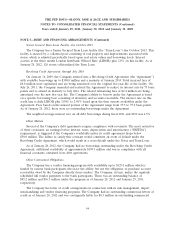

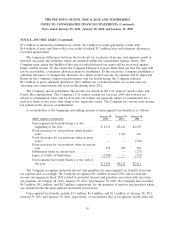

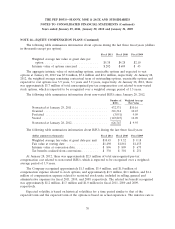

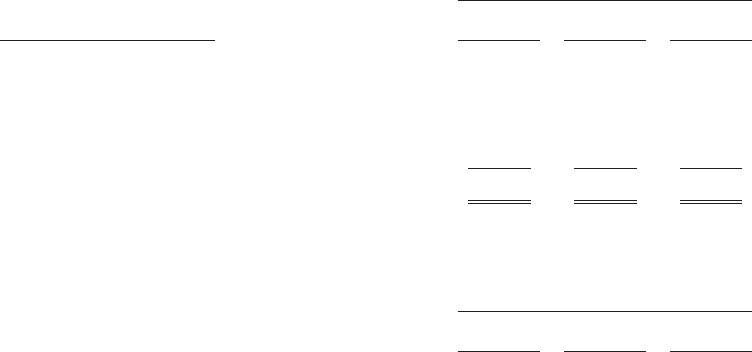

Pension expense follows:

Year Ended

January 28, January 29, January 30,

(dollar amounts in thousands) 2012 2011 2010

Service cost ........................... $ — $ — $ —

Interest cost ........................... 2,558 2,561 2,539

Expected return on plan assets .............. (2,745) (2,151) (1,804)

Amortization of prior service cost . . . . . . . . . . . 14 14 14

Recognized actuarial loss .................. 1,499 1,672 1,766

Total pension expense .................... $1,326 $ 2,096 $ 2,515

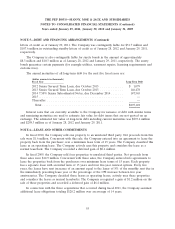

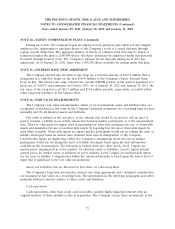

The following actuarial assumptions were used to determine benefit obligation and pension

expense:

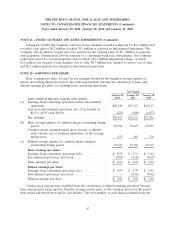

Year Ended

January 22, January 29, January 30,

2012 2011 2010

Benefit obligation assumptions:

Discount rate .......................... 4.60% 5.70% 6.10%

Rate of compensation increase . . . . . . . . . . . . . . N/A N/A N/A

Pension expense assumptions:

Discount rate .......................... 5.70% 6.10% 7.00%

Expected return on plan assets .............. 6.80% 6.95% 6.70%

Rate of compensation expense . . . . . . . . . . . . . . N/A N/A N/A

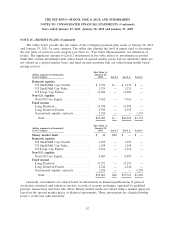

The Company selected the discount rate for the benefit obligation at January 29, 2011 to reflect a

rate commensurate with a model bond portfolio with durations that match the expected payment

patterns of the plans. To develop the expected long-term rate of return on assets assumption, the

Company considered the historical returns and the future expectations for returns for each asset class,

as well as the target asset allocation of the pension portfolio. This resulted in the selection of a

long-term rate of return on assets of 6.80% for fiscal 2011, 6.95% for fiscal 2010 and 6.70% for fiscal

2009.

64