Pep Boys 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

PEP BOYS’ STATEMENT IN OPPOSITION TO THE FOREGOING SHAREHOLDER PROPOSAL

Through the efforts of its Compensation Committee, the Board of Directors has adopted an executive

compensation program, which it believesplays a material role in our ability to drive strong financial results and to

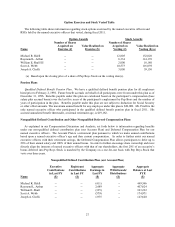

attract and retain a highly experienced and successful management team. An average of 61% (73% for our

President & CEO) of our named executive officers’ compensation is “at-risk” compensation that is only earned and

paid if pre-established performance levels are achieved. The stock-based compensation (options, performance-

based restricted stock units (PSUs) and the Company match portion of our deferred compensation plan) are already

structured to incentivize our executive officers to prioritize the long-term performance of the Company. All such

awards are subject to three-year vesting periods and their value is derived entirely from the Company’s performance

over such vesting periods.

In addition, our executive officers are subject to share ownership guidelines pursuant to which they are expected

to hold Pep Boys Stock with a value equal to the following multiples of their annual salary: President & Chief

Executive Officer 5x; Executive Vice President 3x; Senior Vice President 2x; and Vice President 1x. Our executive

officers are also subject to a recoupment policy, pursuant to which all or a part of previously paid performance

compensation is subject to being recovered by the Company in certain situations. Furthermore, our executive

officers are already prohibited from entering into hedging transactions involving Pep Boys Stock.

For further detail regarding our executive compensation program see the preceding discussion under,

“EXECUTIVE COMPENSATION –Compensation Discussion and Analysis” included in this Proxy Statement.

Accordingly, the Board does not believe the extraordinary step of requiring the Company’s executive officers to

retain Pep Boys Stock following the termination of employment is necessary to secure their focus on the Company’s

long-term stock price performance. In fact, the Board believes that such a policy would be viewed by our executive

officers as punitive in nature. A stock retention requirement that continues for a year after an executive is no longer

employed by the Company, such as the one proposed, could lessen the incentive value of equity awards or, worse,

motivate executive officers who have been successful in enhancing shareholder value to leave the Company or retire

earlier than they otherwise would have, in order to be able to share in the value they helped create. The proposal

would effectively require a “lock-up” of a significant portion of an executive’s stock, which, since equity

compensation is a significant element of compensation for our executive officers, represents a substantial proportion

of their net worth. Accordingly, the proposal would undermine the effectiveness of our compensation program and

our ability to attract, retain and motivate highly qualified and effective executives.

For these reasons we believe that this shareholder proposal is not in the best interests of the Company or its

shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

"AGAINST"

SHAREHOLDER PROPOSAL REGARDING

REQUIRING OUR EXECUTIVE OFFICERS TO RETAIN PEP BOYS STOCK

FOLLOWING THE TERMINATION OF THEIR EMPLOYMENT