Pep Boys 2011 Annual Report Download - page 154

Download and view the complete annual report

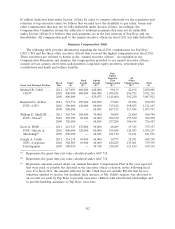

Please find page 154 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60 days of March 5, 2012 are considered to be beneficially owned by such person. Unless

otherwise indicated in the footnotes, the person or entity named has sole voting power

and sole dispositive power with respect to all shares indicated.

(2) Unless otherwise indicated the address of each individual listed in this table is c/o The

Pep Boys—Manny, Moe & Jack, Attention: Secretary, 3111 West Allegheny Avenue,

Philadelphia, Pennsylvania 19132.

(3) Information is based on the Schedule 13G/A filed on February 10, 2012 by North Run

Advisors, LLC, North Run GP, LP, North Run Capital, LP, Todd B. Hammer and

Thomas B. Ellis (the ‘‘North Run Reporting Persons’’), which sets forth their beneficial

ownership based on the number of shares of Pep Boys common stock outstanding as of

November 25, 2011. The North Run Reporting Persons have shared voting power and

shared dispositive power with respect to all of the 4,050,000 shares of common stock

beneficially owned by them.

(4) Information is based on the Schedule 13G/A filed on February 10, 2012 by

BlackRock, Inc.

(5) Information is based on the Schedule 13G filed on February 14, 2012 by Dimensional

Fund Advisors LP. Dimensional Fund Advisors LP has sole voting power with respect to

3,982,565 shares of common stock beneficially owned and sole dispositive power with

respect to 4,072,323 shares of common stock beneficially owned.

(6) Information is based on the Schedule 13G filed on February 9, 2012 by The Vanguard

Group, Inc.—23-1945930. The Vanguard Group, Inc.—23-1945930 has sole voting power

with respect to 73,528 shares of common stock beneficially owned, sole dispositive power

with respect to 2,649,448 shares of common stock beneficially owned and shared

dispositive power with respect to 73,528 shares of common stock beneficially owned.

(7) Information is based on the Schedule 13D filed on February 8, 2012 by The Gores

Group, LLC. Pursuant to Section 13(d)(3) of the Securities Act of 1933, BlackRock, Inc.

and/or entities controlled by BlackRock, Inc. and Gores and/or its affiliates may be

considered to be a ‘‘group.’’ The Gores Group, LLC disclaims any membership or

participation in a ‘‘group’’ with BlackRock, Inc. and/or entities controlled by

BlackRock, Inc. and further disclaims beneficial ownership of any shares of common stock

beneficially owned by BlackRock, Inc. and/or entities controlled by BlackRock, Inc.,

including 4,452,170 shares of common stock believed to be beneficially owned by

BlackRock, Inc.

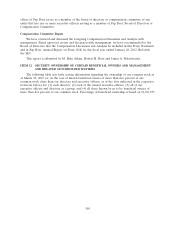

ITEM 13 CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Audit Committee, which is comprised of independent directors, has established a written

Related Party Transaction Policy. Such policy provides that to help identify related-party transactions

and relationships (i) all transactions between the Company and another party are reviewed by the

Company’s legal and finance departments prior to the execution of definitive transaction documents

and (ii) each director and executive officer completes a questionnaire that requires the disclosure of

any transaction or relationship that the person, or any member of his or her immediate family, has or

will have with the Company. The full Board of Directors reviews and approves, ratifies or rejects any

transactions and relationships of the nature that would be required to be disclosed under Item 404 of

Regulation S-K. In reviewing any such related-party transaction or relationship, the Board considers

such information as it deems important to determine whether the transaction is on reasonable and

competitive terms and is fair to the Company. No such relationships or transactions of a nature

required to be disclosed under Item 404 of Regulation S-K currently exist.

110