Pep Boys 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

NOTE 14—EQUITY COMPENSATION PLANS

The Company has a stock-based compensation plan originally approved by the stockholders on

May 21, 1990 under which it has previously granted non-qualified stock options and incentive stock

options to key employees and members of its Board of Directors. There are no awards remaining

available for grant under the 1990 Plan. The Company has a stock-based compensation plan originally

approved by the stockholders on June 2, 1999 under which it has previously granted and may continue

to grant non-qualified stock options, incentive stock options and restricted stock units (‘‘RSUs’’) to key

employees and members of its Board of Directors. On June 24, 2009, the stockholders renamed the

1999 Plan to the 2009 Plan, extended its terms to December 31, 2014 and increased the number of

shares issuable thereunder by 1,500,000. As of January 28, 2012, there were 2,952,304 awards

outstanding and 1,232,934 awards available for grant under the 2009 Plan.

Incentive stock options and non-qualified stock options granted under the 1990 and 2009 plans to

non-officers vest fully on the third anniversary of their grant date and officers vest in equal tranches

over three or four year periods. Generally, all options granted prior to March 3, 2004 carry an

expiration date of ten years and options granted on or after March 3, 2004 carry an expiration date of

seven years. RSUs previously granted to non-officers vest fully on the third anniversary of their grant

date. RSUs previously granted to officers vest in equal tranches over three or four year periods.

The Company has also granted RSUs under the 2009 plan in conjunction with its non-qualified

deferred compensation plan. Under the deferred compensation plan, the first 20% of an officer’s bonus

deferred into the Company’s stock fund is matched by the Company on a one-for-one basis with RSUs

that vest over a three-year period, with one third vesting on each of the first three anniversaries of the

grant date.

The exercise price, term and other conditions applicable to future stock option and RSU grants

under the 2009 plan are generally determined by the Board of Directors; provided that the exercise

price of stock options must be at least 100% of the quoted market price of the common stock on the

grant date. The Company currently satisfies all share requirements resulting from RSU conversions and

option exercises from its treasury stock. The Company believes its treasury share balance at January 28,

2012 is adequate to satisfy such activity during the next twelve-month period.

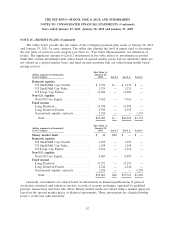

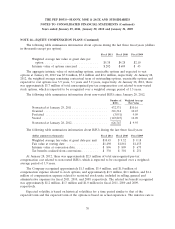

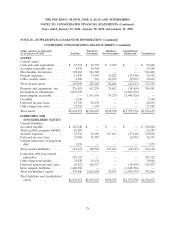

The following table summarizes the options under the plans:

Fiscal Year 2011

Weighted Average

Shares Exercise Price

Outstanding—beginning of year .................. 1,831,802 $ 8.55

Granted .................................... 265,139 12.30

Exercised ................................... (45,321) 7.13

Forfeited ................................... (10,507) 9.01

Expired .................................... (32,683) 15.01

Outstanding—end of year ....................... 2,008,430 8.97

Vested and expected to vest options—end of year ..... 1,978,204 8.92

Options exercisable—end of year ................. 1,241,128 $ 9.13

69