Pep Boys 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

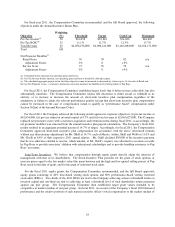

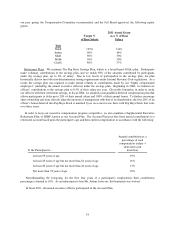

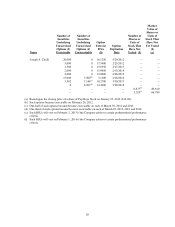

our peer group, the Compensation Committee recommended, and the full Board approved, the following equity

grants.

Target %

of Base Salary

2011 Actual Grant

as a % of Base

Salary

Title

Odell 125% 134%

Arthur 50% 48%

Shull 50% 50%

Webb 50% 50%

Cirelli 40% 37%

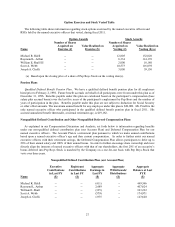

Retirement Plans. We maintain The Pep Boys Savings Plan, which is a broad-based 401(k) plan. Participants

make voluntary contributions to the savings plan, and we match 50% of the amounts contributed by participants

under the savings plan, up to 6% of salary. Due to low levels of participation in the savings plan, the plan

historically did not meet the non-discriminatory testing requirements under Internal Revenue Code regulations. As a

result, the savings plan was required to make annual refunds of contributions made by our “highly compensated

employees” (including the named executive officers) under the savings plan. Beginning in 2004, we limited our

officers’ contributions to the savings plan to 0.5% of their salary per year. Given this limitation, in order to assist

our officers with their retirement savings, in fiscal 2004, we adopted a non-qualified deferred compensation plan that

allows participants to defer up to 20% of their annual salary and 100% of their annual bonus. To further encourage

share ownership and more directly align the interests of management with that of its shareholders, the first 20% of an

officer’s bonus deferred into Pep Boys Stock is matched by us on a one-for-one basis with Pep Boys Stock that vests

over three years.

In order to keep our executive compensation program competitive, we also maintain a Supplemental Executive

Retirement Plan, or SERP, known as our Account Plan. The Account Plan provides fixed annual contributions to a

retirement account based upon the participant’s age and then current compensation in accordance with the following:

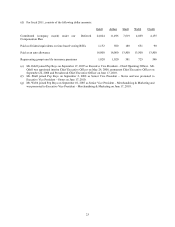

If the Participant is…

Annual contribution as a

percentage of cash

compensation (salary +

short-term cash

incentive)

At least 55 years of age 19%

At least 45 years of age but not more than 54 years of age 16%

At least 40 years of age but not more than 44 years of age 13%

Not more than 39 years of age 10%

Notwithstanding the foregoing, for the first four years of a participant’s employment, their contribution

percentage is limited to 10%. As an inducement to hire Mr. Arthur, however, this limitation was waived.

In fiscal 2011, all named executive officers participatedin the Account Plan.