Pep Boys 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

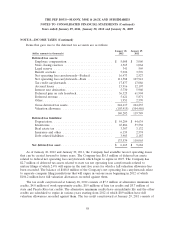

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

In September 2011, the FASB issued ASU 2011-08, ‘‘Intangibles—Goodwill and Other

(Topic 350)—Testing Goodwill for Impairment’’ (‘‘ASU 2011-08’’). The new guidance provides entities

with the option to perform a qualitative assessment of whether it is more likely than not that the fair

value of a reporting unit is less than its carrying amount before applying the quantitative two-step

goodwill impairment test. If an entity concludes that it is not more likely than not that the fair value of

a reporting unit is less than its carrying amount, it would not be required to perform the quantitative

two-step goodwill impairment test. Entities also have the option to bypass the assessment of qualitative

factors for any reporting unit in any period and proceed directly to performing the first step of the

quantitative two-step goodwill impairment test, as was required prior to the issuance of this new

guidance. The new guidance is effective for fiscal years, and interim periods within those years,

beginning after December 15, 2011, with early adoption permitted. The Company does not believe the

adoption of ASU 2011-08 will have a material impact on the consolidated results of operations and

financial condition.

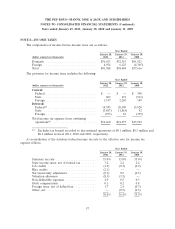

NOTE 2—ACQUISITIONS

During fiscal 2011, the Company made three separate acquisitions. The Company acquired the

assets related to seven service and tire centers located in the Seattle-Tacoma area, the assets related to

seven service and tire centers located in the Houston, Texas area and all outstanding shares of capital

stock of Tire Stores Group Holding Corporation which operated an 85-store chain in Florida, Georgia

and Alabama under the name Big 10. Collectively, the acquired stores produced approximately

$94.7 million (unaudited) in sales annually based on pre-acquisition historical information. The total

purchase price of these stores was approximately $42.6 million in cash and the assumption of certain

liabilities. The acquisitions were financed through cash flows provided by operations. The results of

operations of these acquired stores are included in the Company’s results from their respective

acquisition dates.

The Company has recorded its initial accounting for these acquisitions in accordance with

accounting guidance on business combinations. The acquisitions resulted in goodwill related to, among

other things, growth opportunities and assembled workforces. A portion of the goodwill is expected to

be deductible for tax purposes. The Company has recorded finite-lived intangible assets at their

estimated fair value related to trade name, favorable and unfavorable leases.

The Company expensed all costs related to these acquisitions during fiscal 2011. The total costs

related to these acquisitions were $1.5 million and are included in the consolidated statement of

operations within selling, general and administrative expenses.

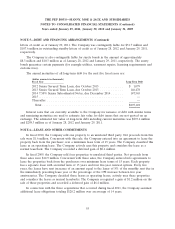

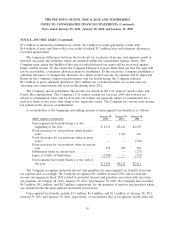

The purchase price of the acquisitions has been allocated to the net tangible and intangible assets

acquired, with the remainder recorded as goodwill on the basis of estimated fair values. In the fourth

quarter of 2011, the Company revised its estimates, which resulted in an increase in goodwill of

$0.7 million from our previous allocation of purchase price. The change related primarily to the

51