Pep Boys 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

The following discussion and analysis explains the results of our operations for fiscal 2011 and

2010 and developments affecting our financial condition as of January 28, 2012. This discussion and

analysis below should be read in conjunction with Item 6 ‘‘Selected Consolidated Financial Data,’’ and

our consolidated financial statements and the notes included elsewhere in this report. The discussion

and analysis contains ‘‘forward looking statements’’ within the meaning of The Private Securities

Litigation Reform Act of 1995. Forward looking statements include management’s expectations

regarding implementation of its long-term strategic plan, future financial performance, automotive

aftermarket trends, levels of competition, business development activities, future capital expenditures,

financing sources and availability and the effects of regulation and litigation. Actual results may differ

materially from the results discussed in the forward looking statements due to a number of factors

beyond our control, including those set forth under the section entitled ‘‘Item 1A Risk Factors’’

elsewhere in this report.

Introduction

The Pep Boys-Manny, Moe & Jack is the leading national chain offering automotive service, tires,

parts and accessories. This positioning allows us to streamline the distribution channel and pass the

savings on to our customers facilitating our vision to be the automotive solutions provider of choice for

the value-oriented customer. The majority of our stores are in a Supercenter format, which serves both

‘‘do-it-for-me’’ (‘‘DIFM’’, which includes service labor, installed merchandise and tires) and ‘‘do-it-

yourself’’ (‘‘DIY’’) customers with the highest quality service offerings and merchandise. Most of our

Supercenters also have a commercial sales program that provides delivery of tires, parts and other

products to automotive repair shops and dealers. In 2009, as part of our long-term strategy to lead with

automotive service, we began complementing our existing Supercenter store base with Service & Tire

Centers. These Service & Tire Centers are designed to capture market share and leverage our existing

Supercenter and support infrastructure. This growth will occur both organically and through

acquisitions. The growth is targeted at existing markets, but may include new markets opportunistically.

Acquisitions will be used to accelerate growth in markets where the Company is under-penetrated.

During fiscal 2011, we acquired 99 Service & Tire Centers (see Note 2 of the Notes to

Consolidated Financial Statements in ‘‘Item 8 Financial Statements and Supplementary Data’’), opened

20 new Service & Tire Centers and one new Supercenter, converted one Pep Express (retail only) store

and one Service & Tire Center to Supercenters, and closed three stores. We are targeting a total of 75

new Service & Tire Centers and 10 Supercenters in fiscal 2012. As of January 28, 2012, we operated

562 Supercenters and 169 Service & Tire Centers, as well as seven legacy Pep Express stores

throughout 35 states and Puerto Rico.

EXECUTIVE SUMMARY

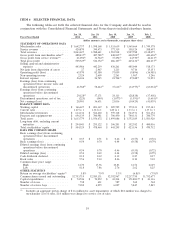

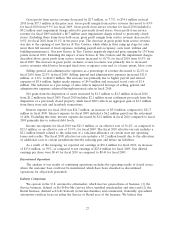

Net earnings for fiscal 2011 were $28.9 million, a $7.7 million decrease from the $36.6 million

reported for fiscal 2010. The decrease in profitability was primarily due to lower total gross profit

margins, higher selling, general and administrative expenses, and lower net gains from disposition of

assets. The current year net earnings also benefitted from a reduction in the effective tax rate which

declined from 36.4% in fiscal year 2010 to 30.0% in the current year. Our diluted earnings per share

for fiscal 2011 were $0.54, a decrease of $0.15 from the $0.69 recorded for fiscal 2010.

Total revenue increased for fiscal 2011 by 3.8% as compared to fiscal 2010 as a result of our

growth strategy. This increase in total revenues was comprised of a 7.8% increase in service revenue

and a 2.8% increase in merchandise sales. For fiscal 2011, comparable store sales (sales generated by

21