Pep Boys 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are adequate and that the ultimate resolution of these matters will not have a material adverse effect

on the Company’s financial position. However, there exists a possibility of loss in excess of the amounts

accrued, the amount of which cannot currently be estimated. While the Company does not believe that

the amount of such excess loss could be material to the Company’s financial position, any such loss

could have a material adverse effect on the Company’s results of operations in the period(s) during

which the underlying matters are resolved.

ITEM 4 (REMOVED AND RESERVED)

PART II

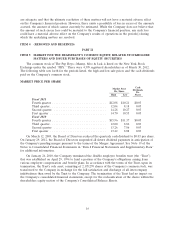

ITEM 5 MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of The Pep Boys—Manny, Moe & Jack is listed on the New York Stock

Exchange under the symbol ‘‘PBY.’’ There were 4,399 registered shareholders as of March 30, 2012.

The following table sets forth for the periods listed, the high and low sale prices and the cash dividends

paid on the Company’s common stock.

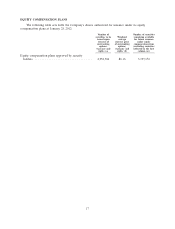

MARKET PRICE PER SHARE

Cash

Market Price Dividends

Per Share Per

High Low Share

Fiscal 2011

Fourth quarter ............................... $12.08 $10.21 $0.03

Third quarter ................................ 12.04 8.18 0.03

Second quarter .............................. 14.28 10.27 0.03

First quarter ................................ 14.70 10.53 0.03

Fiscal 2010

Fourth quarter ............................... $15.96 $11.37 $0.03

Third quarter ................................ 12.00 8.82 0.03

Second quarter .............................. 13.26 7.86 0.03

First quarter ................................ 13.42 8.08 0.03

On March 12, 2009, the Board of Directors reduced the quarterly cash dividend to $0.03 per share.

On January 29, 2012, the Board of Directors suspended all future dividend payments in anticipation of

the Company’s pending merger pursuant to the terms of the Merger Agreement. See Note 19 of the

Notes to Consolidated Financial Statements in ‘‘Item 8 Financial Statements and Supplementary Data’’

for additional information.

On January 26, 2010, the Company terminated the flexible employee benefits trust (the ‘‘Trust’’)

that was established on April 29, 1994 to fund a portion of the Company’s obligations arising from

various employee compensation and benefit plans. In accordance with the terms of the Trust, upon its

termination, the Trust’s sole asset, consisting of 2,195,270 shares of the Company’s common stock, was

transferred to the Company in exchange for the full satisfaction and discharge of all intercompany

indebtedness then owed by the Trust to the Company. The termination of the Trust had no impact on

the Company’s consolidated financial statements, except for the reclassification of the shares within the

shareholders equity section of the Company’s Consolidated Balance Sheets.

16