Pep Boys 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.effect. Legislation changes currently proposed by certain states in which we operate, if enacted,

could increase our transactions or activities subject to tax. Any such legislation that becomes law

could result in an increase in our state income tax expense and our state income taxes paid,

which could have a material effect on our net earnings.

At any one time our tax returns for many tax years are subject to examination by U.S. Federal,

commonwealth, and state taxing jurisdictions. For income tax benefits related to uncertain tax

positions to be recognized, a tax position must be more-likely-than-not to be sustained upon

examination by taxing authorities. The amount recognized is measured as the largest amount of

benefit that is greater than 50 percent likely of being realized upon ultimate settlement. An

uncertain income tax position will not be recognized in the financial statements unless it is

more-likely-than-not to be sustained. We adjust these tax liabilities, as well as the related interest

and penalties, based on the latest facts and circumstances, including recently published rulings,

court cases, and outcomes of tax audits. To the extent our actual tax liability differs from our

established tax liabilities for unrecognized tax benefits, our effective tax rate may be materially

impacted. While it is often difficult to predict the final outcome of, the timing of, or the tax

treatment of any particular tax position or deduction, we believe that our tax balances reflect the

more-likely-than-not outcome of known tax contingencies.

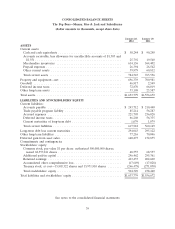

The temporary differences between the book and tax treatment of income and expenses result in

deferred tax assets and liabilities, which are included within our consolidated balance sheets. We

must then assess the likelihood that our deferred tax assets will be recovered from future taxable

income. To the extent we believe that recovery is not more-likely-than-not, we must establish a

valuation allowance. To the extent we establish a valuation allowance or change the allowance in

a future period, income tax expense will be impacted. Actual results could differ from this

assessment if adequate taxable income is not generated in future periods from either operations

or projected tax planning strategies.

RECENT ACCOUNTING STANDARDS

In January 2010, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting Standards

Update (‘‘ASU’’) 2010-06 ‘‘Fair Value Measurements—Improving Disclosures on Fair Value

Measurements’’ (‘‘ASU 2010-06’’). This guidance requires new disclosures surrounding transfers in and

out of level 1 or 2 in the fair value hierarchy and also requires that the reconciliation of level 3 inputs

includes separately reported information on purchases, sales, issuances and settlements. The increased

disclosures should be reported for each class of assets or liabilities. ASU 2010-06 also clarifies existing

disclosures for the level of disaggregating, disclosures about valuation techniques and inputs used to

determine level 2 or 3 fair value measurements and includes conforming amendments to the guidance

on employers’ disclosures about postretirement benefit plan assets. ASU 2010-06 was effective for

interim and annual reporting periods beginning after December 15, 2009 except for the disclosures

about purchases, sales, issuances or settlements in the roll forward activity for level 3 fair value

measurements which are effective for interim and annual periods beginning after December 15, 2010.

The adoption of ASU 2010-06 did not have a material impact on the Company’s consolidated financial

statements.

In December 2010, the FASB issued ASU 2010-29 ‘‘Business Combinations (Topic 805)—

Disclosure of Supplementary Pro Forma Information for Business Combinations’’ (ASU 2010-29). This

accounting standard update clarifies that SEC registrants presenting comparative financial statements

should disclose in their pro forma information revenue and earnings of the combined entity as though

the current period business combinations had occurred as of the beginning of the comparable prior

annual reporting period only. The update also expands the supplemental pro forma disclosures to

include a description of the nature and amount of material, nonrecurring pro forma adjustments

directly attributable to the business combination included in the reported pro forma revenue and

35